DUALTT-AONM-YRXY-MOHJ-EUJY

A

D

R

LABAMA

EPARTMENT OF

EVENUE

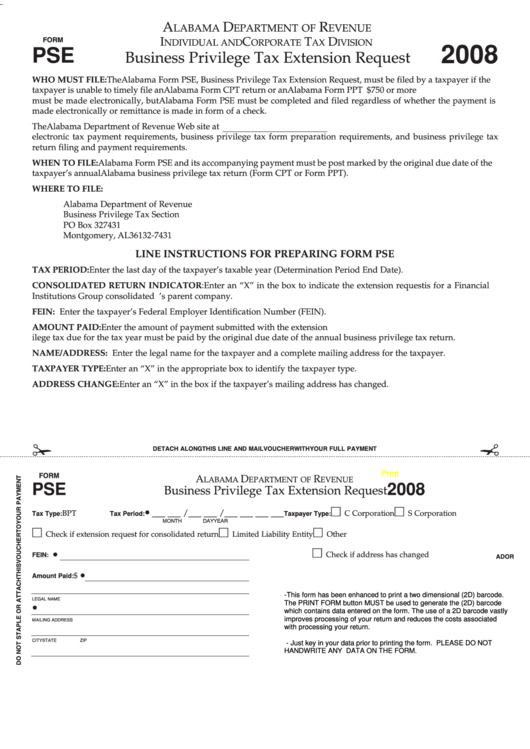

FORM

I

C

T

D

NDIVIDUAL AND

ORPORATE

AX

IVISION

2008

PSE

Business Privilege Tax Extension Request

WHO MUST FILE: The Alabama Form PSE, Business Privilege Tax Extension Request, must be filed by a taxpayer if the

taxpayer is unable to timely file an Alabama Form CPT return or an Alabama Form PPT return. Payments of $750 or more

must be made electronically, but Alabama Form PSE must be completed and filed regardless of whether the payment is

made electronically or remittance is made in form of a check.

The Alabama Department of Revenue Web site at provides additional information concerning

electronic tax payment requirements, business privilege tax form preparation requirements, and business privilege tax

return filing and payment requirements.

WHEN TO FILE: Alabama Form PSE and its accompanying payment must be post marked by the original due date of the

taxpayer’s annual Alabama business privilege tax return (Form CPT or Form PPT).

WHERE TO FILE:

Alabama Department of Revenue

Business Privilege Tax Section

PO Box 327431

Montgomery, AL 36132-7431

LINE INSTRUCTIONS FOR PREPARING FORM PSE

TAX PERIOD: Enter the last day of the taxpayer’s taxable year (Determination Period End Date).

CONSOLIDATED RETURN INDICATOR: Enter an “X” in the box to indicate the extension request is for a Financial

Institutions Group consolidated return. The FEIN provided must be that of the group’s parent company.

FEIN: Enter the taxpayer’s Federal Employer Identification Number (FEIN).

AMOUNT PAID: Enter the amount of payment submitted with the extension request. The full amount of business priv-

ilege tax due for the tax year must be paid by the original due date of the annual business privilege tax return.

NAME/ADDRESS: Enter the legal name for the taxpayer and a complete mailing address for the taxpayer.

TAXPAYER TYPE: Enter an “X” in the appropriate box to identify the taxpayer type.

ADDRESS CHANGE: Enter an “X” in the box if the taxpayer’s mailing address has changed.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

Print

Reset

FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

PSE

2008

Business Privilege Tax Extension Request

Tax Period: •

___ ___ /___ ___ /___ ___ ___ ___

Tax Type: BPT

Taxpayer Type:

C Corporation

S Corporation

MONTH

DAY

YEAR

Check if extension request for consolidated return

Limited Liability Entity

Other

FEIN: •

Check if address has changed

ADOR

$ •

Amount Paid:

-This form has been enhanced to print a two dimensional (2D) barcode.

LEGAL NAME

The PRINT FORM button MUST be used to generate the (2D) barcode

•

which contains data entered on the form. The use of a 2D barcode vastly

improves processing of your return and reduces the costs associated

MAILING ADDRESS

with processing your return.

CITY

STATE

ZIP

- Just key in your data prior to printing the form. PLEASE DO NOT

HANDWRITE ANY DATA ON THE FORM.

1

1