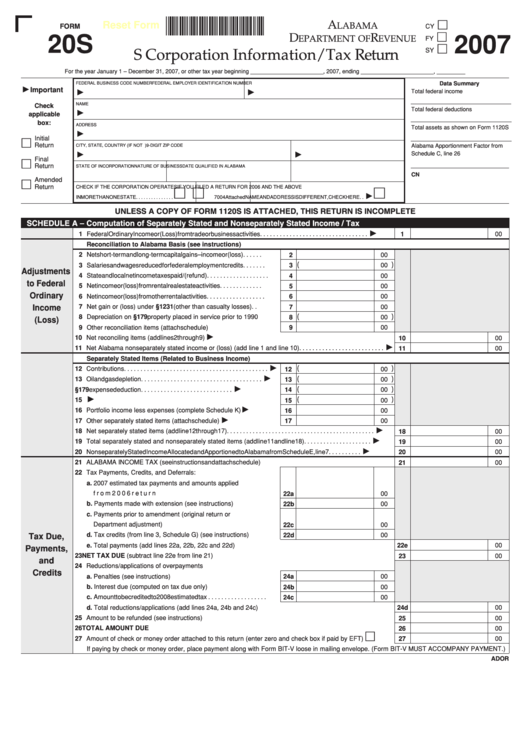

0700012S

A

Reset Form

LABAMA

CY

FORM

20S

2007

D

R

EPARTMENT OF

EVENUE

FY

SY

S Corporation Information/Tax Return

For the year January 1 – December 31, 2007, or other tax year beginning _______________________, 2007, ending _______________________, _________

Data Summary

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Important

Total federal income

Check

NAME

Total federal deductions

applicable

box:

ADDRESS

Total assets as shown on Form 1120S

Initial

Return

Alabama Apportionment Factor from

CITY, STATE, COUNTRY (IF NOT U.S.)

9-DIGIT ZIP CODE

Schedule C, line 26

Final

Return

STATE OF INCORPORATION

NATURE OF BUSINESS

DATE QUALIFIED IN ALABAMA

CN

Amended

Return

CHECK IF THE CORPORATION OPERATES

IF YOU FILED A RETURN FOR 2006 AND THE ABOVE

IN MORE THAN ONE STATE . . . . . . . . . . . . . . .

7004 Attached NAME AND ADDRESS IS DIFFERENT, CHECK HERE. .

UNLESS A COPY OF FORM 1120S IS ATTACHED, THIS RETURN IS INCOMPLETE

SCHEDULE A – Computation of Separately Stated and Nonseparately Stated Income / Tax

1 Federal Ordinary Income or (Loss) from trade or business activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

Reconciliation to Alabama Basis (see instructions)

2 Net short-term and long-term capital gains – income or (loss) . . . . . .

2

00

(

)

3 Salaries and wages reduced for federal employment credits . . . . . . .

3

00

Adjustments

4 State and local net income taxes paid/(refund). . . . . . . . . . . . . . . . . . .

4

00

to Federal

5 Net income or (loss) from rental real estate activities . . . . . . . . . . . . .

5

00

Ordinary

6 Net income or (loss) from other rental activities . . . . . . . . . . . . . . . . . .

6

00

Income

7 Net gain or (loss) under I.R.C. §1231 (other than casualty losses). .

7

00

(

)

8 Depreciation on I.R.C. §179 property placed in service prior to 1990

8

00

(Loss)

9 Other reconciliation items (attach schedule) . . . . . . . . . . . . . . . . . . . . .

9

00

10 Net reconciling items (add lines 2 through 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Net Alabama nonseparately stated income or (loss) (add line 1 and line 10). . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

Separately Stated Items (Related to Business Income)

(

)

12 Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

(

)

13 Oil and gas depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

(

)

14 I.R.C. §179 expense deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

(

)

15 Casualty losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

16 Portfolio income less expenses (complete Schedule K). . . . . . . .

16

00

17 Other separately stated items (attach schedule) . . . . . . . . . . . . . .

17

00

18 Net separately stated items (add line 12 through 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19 Total separately stated and nonseparately stated items (add line 11 and line 18) . . . . . . . . . . . . . . . . . . . . .

19

00

20 Nonseparately Stated Income Allocated and Apportioned to Alabama from Schedule E, line 7. . . . . . . . . .

20

00

21 ALABAMA INCOME TAX (see instructions and attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Tax Payments, Credits, and Deferrals:

a. 2007 estimated tax payments and amounts applied

from 2006 return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22a

00

b. Payments made with extension (see instructions). . . . . . . . . . . . . .

22b

00

c. Payments prior to amendment (original return or

Department adjustment). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22c

00

d. Tax credits (from line 3, Schedule G) (see instructions). . . . . . . . .

Tax Due,

22d

00

e. Total payments (add lines 22a, 22b, 22c and 22d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22e

00

Payments,

23 NET TAX DUE (subtract line 22e from line 21). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

and

24 Reductions/applications of overpayments

Credits

a. Penalties (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24a

00

b. Interest due (computed on tax due only). . . . . . . . . . . . . . . . . . . . . .

24b

00

c. Amount to be credited to 2008 estimated tax . . . . . . . . . . . . . . . . . .

24c

00

d. Total reductions/applications (add lines 24a, 24b and 24c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24d

00

25 Amount to be refunded (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

26 TOTAL AMOUNT DUE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

27 Amount of check or money order attached to this return (enter zero and check box if paid by EFT) . . . . . .

27

00

If paying by check or money order, place payment along with Form BIT-V loose in mailing envelope. (Form BIT-V MUST ACCOMPANY PAYMENT.)

ADOR

1

1 2

2 3

3 4

4