Form Ftb 621 - Voluntary Compliance Participation Agreement Form

ADVERTISEMENT

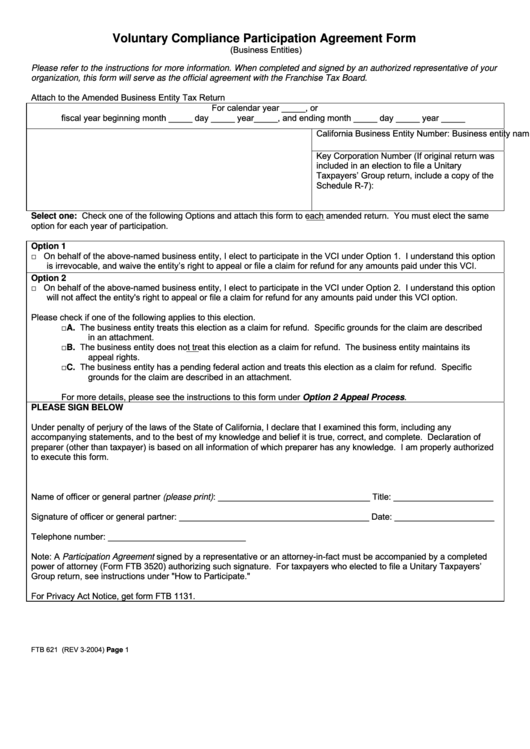

Voluntary Compliance Participation Agreement Form

(Business Entities)

Please refer to the instructions for more information. When completed and signed by an authorized representative of your

organization, this form will serve as the official agreement with the Franchise Tax Board.

Attach to the Amended Business Entity Tax Return

For calendar year _____, or

fiscal year beginning month _____ day _____ year_____, and ending month _____ day _____ year _____

Business entity name as shown on return and current address

California Business Entity Number:

Key Corporation Number (If original return was

included in an election to file a Unitary

Taxpayers’ Group return, include a copy of the

Schedule R-7):

Select one: Check one of the following Options and attach this form to each amended return. You must elect the same

option for each year of participation.

Option 1

□ On behalf of the above-named business entity, I elect to participate in the VCI under Option 1. I understand this option

is irrevocable, and waive the entity’s right to appeal or file a claim for refund for any amounts paid under this VCI.

Option 2

□ On behalf of the above-named business entity, I elect to participate in the VCI under Option 2. I understand this option

will not affect the entity's right to appeal or file a claim for refund for any amounts paid under this VCI option.

Please check if one of the following applies to this election.

□ A. The business entity treats this election as a claim for refund. Specific grounds for the claim are described

in an attachment.

□ B. The business entity does not treat this election as a claim for refund. The business entity maintains its

appeal rights.

□ C. The business entity has a pending federal action and treats this election as a claim for refund. Specific

grounds for the claim are described in an attachment.

For more details, please see the instructions to this form under Option 2 Appeal Process.

PLEASE SIGN BELOW

Under penalty of perjury of the laws of the State of California, I declare that I examined this form, including any

accompanying statements, and to the best of my knowledge and belief it is true, correct, and complete. Declaration of

preparer (other than taxpayer) is based on all information of which preparer has any knowledge. I am properly authorized

to execute this form.

Name of officer or general partner (please print): ________________________________ Title: _____________________

Signature of officer or general partner: ________________________________________ Date: _____________________

Telephone number: _____________________________

Note: A Participation Agreement signed by a representative or an attorney-in-fact must be accompanied by a completed

power of attorney (Form FTB 3520) authorizing such signature. For taxpayers who elected to file a Unitary Taxpayers’

Group return, see instructions under "How to Participate."

For Privacy Act Notice, get form FTB 1131.

FTB 621 (REV 3-2004) Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1