Print and Reset Form

Reset Form

YEAR

CALIFORNIA FORM

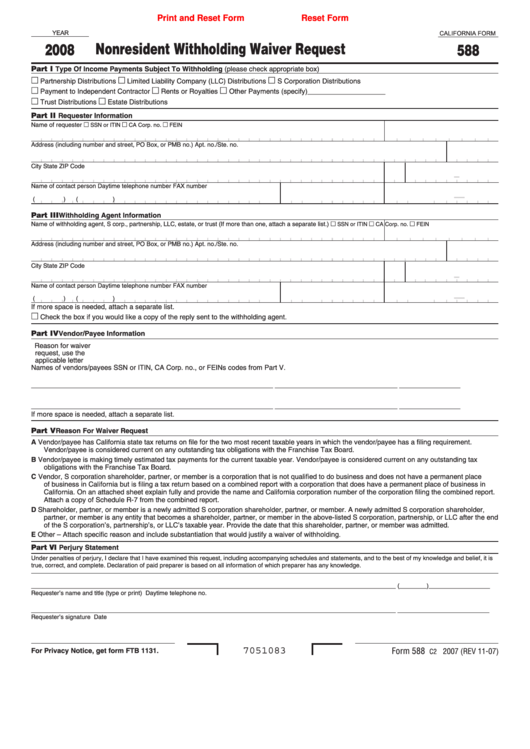

Nonresident Withholding Waiver Request

2008

588

Part I

Type Of Income Payments Subject To Withholding (please check appropriate box)

Partnership Distributions

Limited Liability Company (LLC) Distributions

S Corporation Distributions

Payment to Independent Contractor

Rents or Royalties

Other Payments (specify)____________________

Trust Distributions

Estate Distributions

Part II

Requester Information

Name of requester

SSN or ITIN

CA Corp. no.

FEIN

Address (including number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

–

Name of contact person

Daytime telephone number

FAX number

–

–

(

)

(

)

Part III

Withholding Agent Information

Name of withholding agent, S corp., partnership, LLC, estate, or trust (If more than one, attach a separate list.)

SSN or ITIN

CA Corp. no.

FEIN

Address (including number and street, PO Box, or PMB no.)

Apt. no./Ste. no.

City

State

ZIP Code

–

Name of contact person

Daytime telephone number

FAX number

–

–

(

)

(

)

If more space is needed, attach a separate list.

Check the box if you would like a copy of the reply sent to the withholding agent.

Part IV

Vendor/Payee Information

Reason for waiver

request, use the

applicable letter

Names of vendors/payees

SSN or ITIN, CA Corp. no., or FEINs

codes from Part V.

_______________________________________________________________________

____________________________________

__________________

_______________________________________________________________________

____________________________________

__________________

If more space is needed, attach a separate list.

Part V

Reason For Waiver Request

A

Vendor/payee has California state tax returns on file for the two most recent taxable years in which the vendor/payee has a filing requirement.

Vendor/payee is considered current on any outstanding tax obligations with the Franchise Tax Board.

B

Vendor/payee is making timely estimated tax payments for the current taxable year. Vendor/payee is considered current on any outstanding tax

obligations with the Franchise Tax Board.

C

Vendor, S corporation shareholder, partner, or member is a corporation that is not qualified to do business and does not have a permanent place

of business in California but is filing a tax return based on a combined report with a corporation that does have a permanent place of business in

California. On an attached sheet explain fully and provide the name and California corporation number of the corporation filing the combined report.

Attach a copy of Schedule R-7 from the combined report.

D

Shareholder, partner, or member is a newly admitted S corporation shareholder, partner, or member. A newly admitted S corporation shareholder,

partner, or member is any entity that becomes a shareholder, partner, or member in the above-listed S corporation, partnership, or LLC after the end

of the S corporation’s, partnership’s, or LLC’s taxable year. Provide the date that this shareholder, partner, or member was admitted.

E

Other – Attach specific reason and include substantiation that would justify a waiver of withholding.

Part VI

Perjury Statement

Under penalties of perjury, I declare that I have examined this request, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of paid preparer is based on all information of which preparer has any knowledge.

___________________________________________________________________________________________________________

(________)__________________

Requester’s name and title (type or print)

Daytime telephone no.

___________________________________________________________________________________________________________

___________________________

Requester’s signature

Date

7051083

Form 588

2007 (REV 11-07)

For Privacy Notice, get form FTB 1131.

C2

1

1