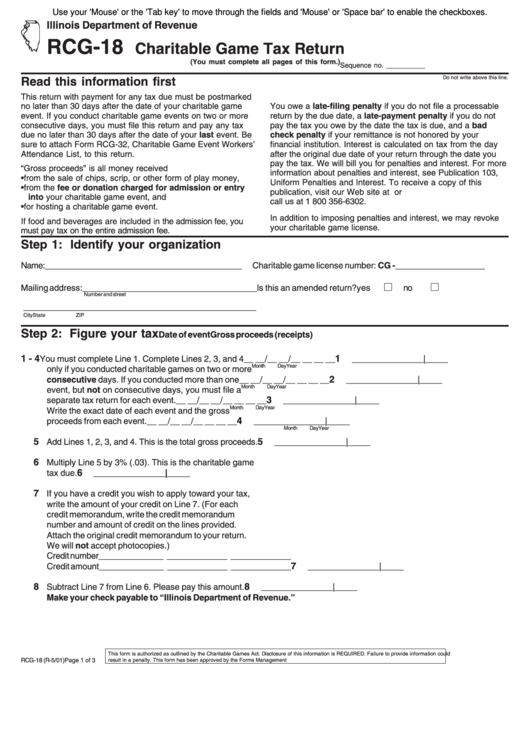

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

RCG-18

Charitable Game Tax Return

(You must complete all pages of this form.)

Sequence no. __________

Do not write above this line.

Read this information first

This return with payment for any tax due must be postmarked

no later than 30 days after the date of your charitable game

You owe a late-filing penalty if you do not file a processable

event. If you conduct charitable game events on two or more

return by the due date, a late-payment penalty if you do not

consecutive days, you must file this return and pay any tax

pay the tax you owe by the date the tax is due, and a bad

due no later than 30 days after the date of your last event. Be

check penalty if your remittance is not honored by your

sure to attach Form RCG-32, Charitable Game Event Workers’

financial institution. Interest is calculated on tax from the day

Attendance List, to this return.

after the original due date of your return through the date you

pay the tax. We will bill you for penalties and interest. For more

“Gross proceeds” is all money received

information about penalties and interest, see Publication 103,

• from the sale of chips, scrip, or other form of play money,

Uniform Penalties and Interest. To receive a copy of this

• from the fee or donation charged for admission or entry

publication, visit our Web site at or

into your charitable game event, and

call us at 1 800 356-6302.

• for hosting a charitable game event.

In addition to imposing penalties and interest, we may revoke

If food and beverages are included in the admission fee, you

your charitable game license.

must pay tax on the entire admission fee.

Step 1: Identify your organization

Name:

____________________________________________

Charitable game license number: CG - ____________________

Mailing address:_______________________________________

Is this an amended return?

yes

no

Number and street

____________________________________________________

City

State

ZIP

Step 2: Figure your tax

Date of event

Gross proceeds (receipts)

1 - 4

1

You must complete Line 1. Complete Lines 2, 3, and 4

__ __/__ __/__ __ __ __

________________|_____

Month

Day

Year

only if you conducted charitable games on two or more

2

consecutive days. If you conducted more than one

__ __/__ __/__ __ __ __

________________|_____

Month

Day

Year

event, but not on consecutive days, you must file a

3

separate tax return for each event.

__ __/__ __/__ __ __ __

________________|_____

Month

Day

Year

Write the exact date of each event and the gross

4

proceeds from each event.

__ __/__ __/__ __ __ __

________________|_____

Month

Day

Year

5

5

Add Lines 1, 2, 3, and 4. This is the total gross proceeds.

________________|_____

6

Multiply Line 5 by 3% (.03). This is the charitable game

6

tax due.

________________|_____

7

If you have a credit you wish to apply toward your tax,

write the amount of your credit on Line 7. (For each

credit memorandum, write the credit memorandum

number and amount of credit on the lines provided.

Attach the original credit memorandum to your return.

We will not accept photocopies.)

Credit number

______________ _____________ _____________

7

Credit amount

______________ _____________ _____________

________________|_____

8

8

Subtract Line 7 from Line 6. Please pay this amount.

________________|_____

Make your check payable to “Illinois Department of Revenue.”

This form is authorized as outlined by the Charitable Games Act. Disclosure of this information is REQUIRED. Failure to provide information could

RCG-18 (R-5/01)

result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2137

Page 1 of 3

1

1 2

2 3

3