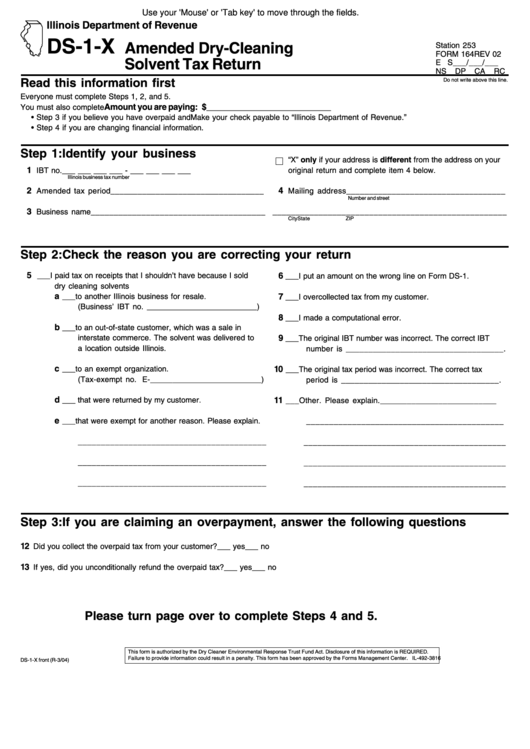

Use your 'Mouse' or 'Tab key' to move through the fields.

Illinois Department of Revenue

DS-1-X

Amended Dry-Cleaning

Station 253

FORM 164 REV 02

Solvent Tax Return

E S

___/___/___

NS DP CA RC

Read this information first

Do not write above this line.

Everyone must complete Steps 1, 2, and 5.

Amount you are paying: $___________________________

You must also complete

• Step 3 if you believe you have overpaid and

Make your check payable to “Illinois Department of Revenue.”

• Step 4 if you are changing financial information.

Step 1: Identify your business

“X” only if your address is different from the address on your

1

IBT no. ___ ___ ___ ___ - ___ ___ ___ ___

original return and complete item 4 below.

Illinois business tax number

2

4

Amended tax period__________________________________

Mailing address___________________________________

Number and street

3

Business name______________________________________

___________________________________________________

City

State

ZIP

Step 2: Check the reason you are correcting your return

5

___ I paid tax on receipts that I shouldn’t have because I sold

6

___ I put an amount on the wrong line on Form DS-1.

dry cleaning solvents

a

___ to another Illinois business for resale.

7

___ I overcollected tax from my customer.

(Business’ IBT no. _________________________)

8

___ I made a computational error.

b

___ to an out-of-state customer, which was a sale in

interstate commerce. The solvent was delivered to

9

___ The original IBT number was incorrect. The correct IBT

a location outside Illinois.

number is ___________________________________.

c

___ to an exempt organization.

10

___ The original tax period was incorrect. The correct tax

(Tax-exempt no. E-_________________________)

period is ___________________________________.

d

11

___ that were returned by my customer.

___ Other. Please explain.__________________________

e

___ that were exempt for another reason. Please explain.

___________________________________________

_________________________________________

____________________________________________

_________________________________________

____________________________________________

_________________________________________

____________________________________________

Step 3: If you are claiming an overpayment, answer the following questions

12

Did you collect the overpaid tax from your customer?

___ yes

___ no

13

If yes, did you unconditionally refund the overpaid tax?

___ yes

___ no

Please turn page over to complete Steps 4 and 5.

This form is authorized by the Dry Cleaner Environmental Response Trust Fund Act. Disclosure of this information is REQUIRED.

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-3816

DS-1-X front (R-3/04)

1

1 2

2