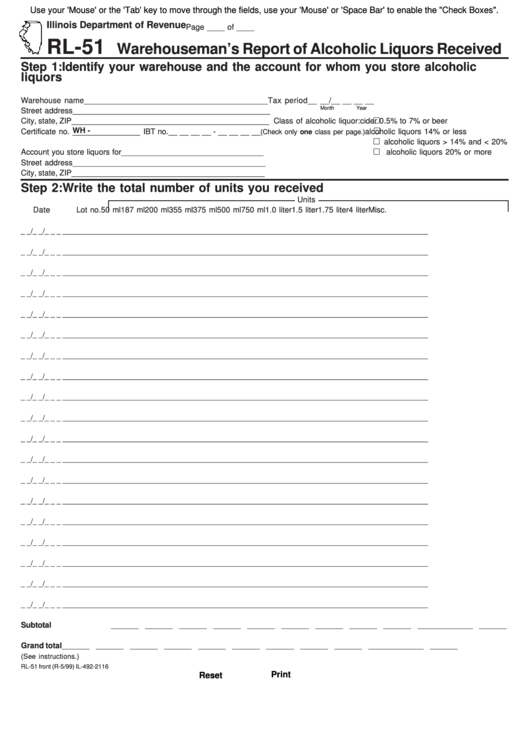

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

Page ____ of ____

RL-51

Warehouseman’s Report of Alcoholic Liquors Received

Step 1: Identify your warehouse and the account for whom you store alcoholic

liquors

Warehouse name________________________________________ Tax period

__ __/__ __ __ __

Month

Year

Street address___________________________________________

City, state, ZIP___________________________________________ Class of alcoholic liquor:

cider 0.5% to 7% or beer

WH -

Certificate no. _______________ IBT no. __ __ __ __ - __ __ __ __

alcoholic liquors 14% or less

(Check only one class per page.)

alcoholic liquors > 14% and < 20%

Account you store liquors for_______________________________

alcoholic liquors 20% or more

Street address__________________________________________

City, state, ZIP__________________________________________

Step 2: Write the total number of units you received

Units

Date

Lot no.

50 ml

187 ml

200 ml

355 ml

375 ml

500 ml

750 ml

1.0 liter 1.5 liter 1.75 liter 4 liter

Misc.

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

_ _/_ _/_ _ _ _ ________ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

Subtotal

_______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

Grand total

_______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______ _______

(See instructions.)

RL-51 front (R-5/99) IL-492-2116

Print

Reset

1

1 2

2