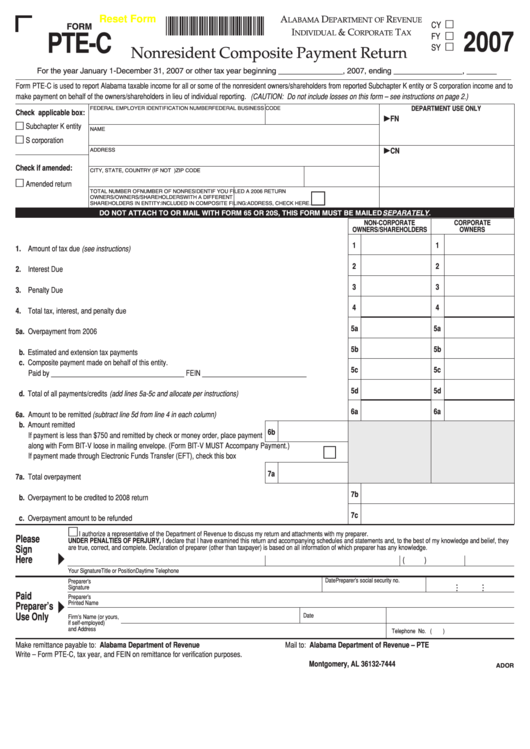

*070001PT*

Reset Form

A

D

R

LABAMA

EPARTMENT OF

EVENUE

CY

FORM

I

& C

T

NDIVIDUAL

ORPORATE

AX

2007

PTE-C

FY

SY

Nonresident Composite Payment Return

For the year January 1-December 31, 2007 or other tax year beginning _______________, 2007, ending ________________, _______

Form PTE-C is used to report Alabama taxable income for all or some of the nonresident owners/shareholders from reported Subchapter K entity or S corporation income and to

make payment on behalf of the owners/shareholders in lieu of individual reporting. (CAUTION: Do not include losses on this form – see instructions on page 2.)

FEDERAL EMPLOYER IDENTIFICATION NUMBER

FEDERAL BUSINESS CODE

DEPARTMENT USE ONLY

Check applicable box:

FN

Subchapter K entity

NAME

S corporation

ADDRESS

CN

Check if amended:

CITY, STATE, COUNTRY (IF NOT U.S.)

ZIP CODE

Amended return

TOTAL NUMBER OF

NUMBER OF NONRESIDENT

IF YOU FILED A 2006 RETURN

OWNERS/

OWNERS/SHAREHOLDERS

WITH A DIFFERENT

SHAREHOLDERS IN ENTITY:

INCLUDED IN COMPOSITE FILING:

ADDRESS, CHECK HERE.

DO NOT ATTACH TO OR MAIL WITH FORM 65 OR 20S, THIS FORM MUST BE MAILED SEPARATELY .

NON-CORPORATE

CORPORATE

OWNERS/SHAREHOLDERS

OWNERS

1

1

1. Amount of tax due (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

2. Interest Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

3. Penalty Due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

4. Total tax, interest, and penalty due. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5a

5a

5a. Overpayment from 2006. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5b

5b

b. Estimated and extension tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c. Composite payment made on behalf of this entity.

5c

5c

Paid by _____________________________________ FEIN _____________________________ . . . . . . . . . . .

5d

5d

d. Total of all payments/credits (add lines 5a-5c and allocate per instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

6a

6a. Amount to be remitted (subtract line 5d from line 4 in each column) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b. Amount remitted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

If payment is less than $750 and remitted by check or money order, place payment

along with Form BIT-V loose in mailing envelope. (Form BIT-V MUST Accompany Payment.)

If payment made through Electronic Funds Transfer (EFT), check this box . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

7a. Total overpayment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

b. Overpayment to be credited to 2008 return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7c

c. Overpayment amount to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

UNDER PENALTIES OF PERJURY, I declare that I have examined this return and accompanying schedules and statements and, to the best of my knowledge and belief, they

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

(

)

Your Signature

Title or Position

Daytime Telephone No.

Date

Date

Preparer’s social security no.

Preparer’s

Signature

Paid

Preparer’s

Printed Name

Preparer’s

Use Only

Date

E.I. No.

Firm’s Name (or yours,

if self-employed)

and Address

Telephone No. (

)

Make remittance payable to: Alabama Department of Revenue

Mail to: Alabama Department of Revenue – PTE

Write – Form PTE-C, tax year, and FEIN on remittance for verification purposes.

P.O. Box 327444

Montgomery, AL 36132-7444

ADOR

1

1 2

2 3

3