Form 42a814 Kira Annual Report - Kentucky 2007

ADVERTISEMENT

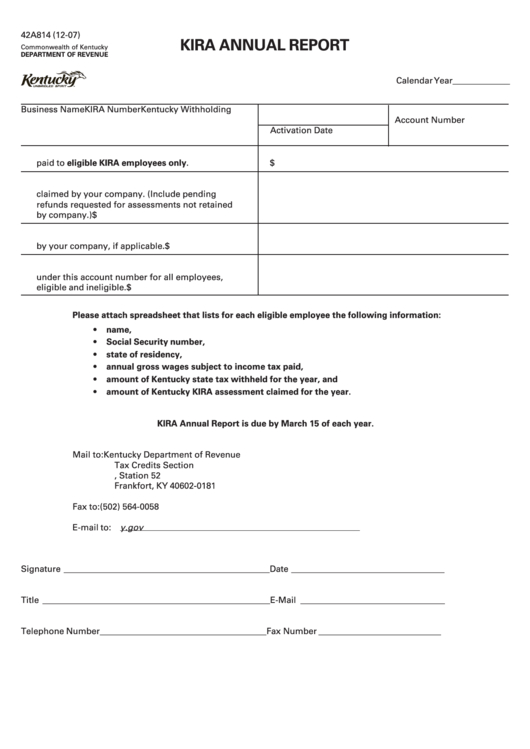

42A814 (12-07)

KIRA ANNUAL REPORT

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Calendar Year_____________

Business Name

KIRA Number

Kentucky Withholding

Account Number

Activation Date

1.

Total annual gross wages subject to income tax

paid to eligible KIRA employees only.

$

2. Total annual Kentucky KIRA assessments

claimed by your company. (Include pending

refunds requested for assessments not retained

by company.)

$

3. Total annual local KIRA assessments claimed

by your company, if applicable.

$

4. Total annual Kentucky tax withheld and reported

under this account number for all employees,

eligible and ineligible.

$

Please attach spreadsheet that lists for each eligible employee the following information:

•

name,

•

Social Security number,

•

state of residency,

•

annual gross wages subject to income tax paid,

•

amount of Kentucky state tax withheld for the year, and

•

amount of Kentucky KIRA assessment claimed for the year.

KIRA Annual Report is due by March 15 of each year.

Mail to:

Kentucky Department of Revenue

Tax Credits Section

P .O. Box 181, Station 52

Frankfort, KY 40602-0181

Fax to:

(502) 564-0058

E-mail to: KRC.WEBResponseEconomicDevelopmentCredits@ky.gov

Signature _______________________________________________

Date ___________________________________

Title ____________________________________________________

E-Mail _________________________________

Telephone Number ______________________________________

Fax Number ____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1