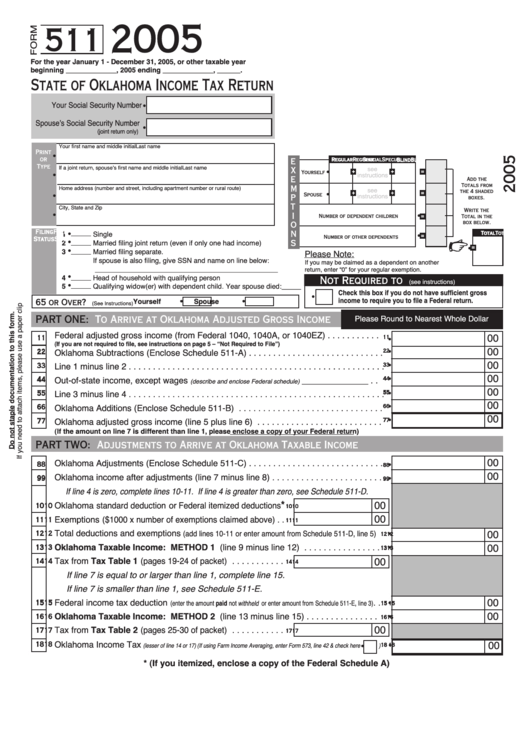

Form 511 - State Of Oklahoma Income Tax Return - 2005

ADVERTISEMENT

2005

511

For the year January 1 - December 31, 2005, or other taxable year

beginning _____________, 2005 ending _____________, ______.

State of Oklahoma Income Tax Return

•

Your Social Security Number

Spouse’s Social Security Number

•

(joint return only)

Your first name and middle initial

Last name

Print

•

or

Regular

Regular

Regular

Regular

Regular

Special

Special

Special

Special

Special

Blind

Blind

Blind

Blind

Blind

E

Type

If a joint return, spouse’s first name and middle initial

Last name

see

•

X

+

+

=

•

Yourself

instructions

E

Add the

Totals from

Home address (number and street, including apartment number or rural route)

M

see

•

the 4 shaded

+

+

=

•

Spouse

instructions

P

boxes.

T

City, State and Zip

Write the

•

•

I

=

Number of dependent children

Total in the

box below.

O

•

Filing

Filing

Filing

Filing

Filing

1

Single

N

•

Total

Total

Total

Total

Total

=

Number of other dependents

Status

Status

Status

Status

Status

•

2

Married filing joint return (even if only one had income)

S

•

=

•

3

Married filing separate.

Please Note:

If spouse is also filing, give SSN and name on line below:

If you may be claimed as a dependent on another

_______________________________________________

return, enter “0” for your regular exemption.

•

4

Head of household with qualifying person

Not Required to File...

(see instructions)

•

5

Qualifying widow(er) with dependent child. Year spouse died:_____

Check this box if you do not have sufficient gross

•

•

•

income to require you to file a Federal return.

Yourself

Spouse

65 or Over?

(See Instructions)

Please Round to Nearest Whole Dollar

PART ONE:

To Arrive at Oklahoma Adjusted Gross Income

Federal adjusted gross income (from Federal 1040, 1040A, or 1040EZ) . . . . . . . . . . .

•

00

1 1 1 1 1

1 1 1 1 1

(If you are not required to file, see instructions on page 5 – “Not Required to File”)

•

00

2 2 2 2 2

Oklahoma Subtractions (Enclose Schedule 511-A) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 2 2 2 2

•

00

Line 1 minus line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 3 3 3 3

3 3 3 3 3

•

00

4 4 4 4 4

4 4 4 4 4

Out-of-state income, except wages

______________ . .

(describe and enclose Federal schedule)

00

•

Line 3 minus line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 5 5 5 5

5 5 5 5 5

00

•

Oklahoma Additions (Enclose Schedule 511-B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 6 6 6 6

6 6 6 6 6

00

•

7 7 7 7 7

7 7 7 7 7

Oklahoma adjusted gross income (line 5 plus line 6) . . . . . . . . . . . . . . . . . . . . . . . . . .

(If the amount on line 7 is different than line 1, please enclose a copy of your Federal return)

PART TWO:

Adjustments to Arrive at Oklahoma Taxable Income

00

Oklahoma Adjustments (Enclose Schedule 511-C) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

8 8 8 8 8

8 8 8 8 8

00

Oklahoma income after adjustments (line 7 minus line 8) . . . . . . . . . . . . . . . . . . . . . . .

•

9 9 9 9 9

9 9 9 9 9

If line 4 is zero, complete lines 10-11. If line 4 is greater than zero, see Schedule 511-D.

*

00

Oklahoma standard deduction or Federal itemized deductions

10

10

10

10

10

10

10

10

10

10

00

Exemptions ($1000 x number of exemptions claimed above) . .

11

11

11

11

11

11

11

11

11

11

•

Total deductions and exemptions

(add lines 10-11 or enter amount from Schedule 511-D, line 5)

00

12

12

12

12

12

12

12

12

12

12

•

Oklahoma Taxable Income: METHOD 1 (line 9 minus line 12) . . . . . . . . . . . . . . . .

00

13

13

13

13

13

13

13

13

13

13

Tax from Tax Table 1 (pages 19-24 of packet) . . . . . . . . . . .

00

14

14

14

14

14

14

14

14

14

14

If line 7 is equal to or larger than line 1, complete line 15.

If line 7 is smaller than line 1, see Schedule 511-E.

•

00

Federal income tax deduction

. .

15

15

15

(enter the amount paid not withheld or enter amount from Schedule 511-E, line 3)

15

15

15

15

15

15

15

•

00

Oklahoma Taxable Income: METHOD 2 (line 13 minus line 15) . . . . . . . . . . . . . . .

16

16

16

16

16

16

16

16

16

16

00

Tax from Tax Table 2 (pages 25-30 of packet) . . . . . . . . . . .

17

17

17

17

17

17

17

17

17

17

•

Oklahoma Income Tax

18

18

•

00

18

18

18

(lesser of line 14 or 17) (If using Farm Income Averaging, enter Form 573, line 42 & check here

)

18

18

18

18

18

* (If you itemized, enclose a copy of the Federal Schedule A)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5