FORM KX-1

Revised 12/05

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

P

: (937) 296-2502 • F

: (937) 296-3242

HONE

AX

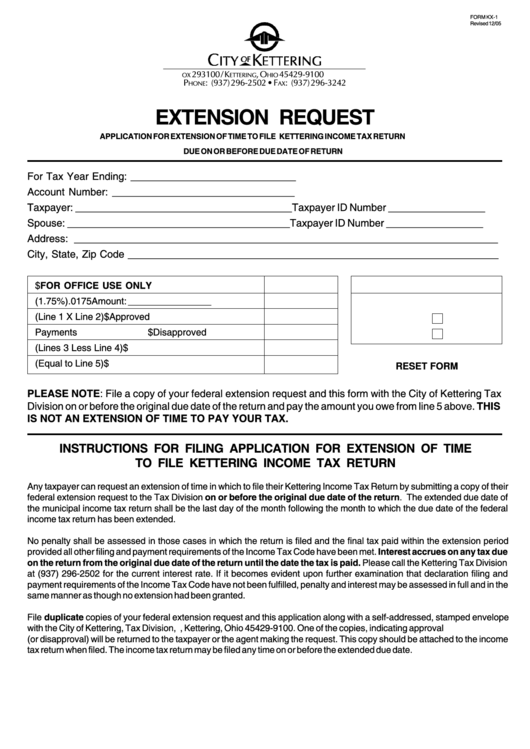

EXTENSION REQUEST

APPLICATION FOR EXTENSION OF TIME TO FILE KETTERING INCOME TAX RETURN

DUE ON OR BEFORE DUE DATE OF RETURN

For Tax Year Ending: _____________________________

Account Number: ________________________________

Taxpayer: ______________________________________ Taxpayer ID Number _________________

Spouse: _______________________________________

Taxpayer ID Number _________________

Address: __________________________________________________________________________

City, State, Zip Code _________________________________________________________________

1. Estimated Total Taxable Income

$

FOR OFFICE USE ONLY

2. Tax Rate (1.75%)

.0175

Amount: ________________

3. Estimated Tax Due (Line 1 X Line 2)

$

Approved

4. Overpayment and/or Prior Payments

$

Disapproved

5. Net Tax Due (Lines 3 Less Line 4)

$

6. Payment With This Application (Equal to Line 5)

$

RESET FORM

PLEASE NOTE: File a copy of your federal extension request and this form with the City of Kettering Tax

Division on or before the original due date of the return and pay the amount you owe from line 5 above. THIS

IS NOT AN EXTENSION OF TIME TO PAY YOUR TAX.

INSTRUCTIONS FOR FILING APPLICATION FOR EXTENSION OF TIME

TO FILE KETTERING INCOME TAX RETURN

Any taxpayer can request an extension of time in which to file their Kettering Income Tax Return by submitting a copy of their

federal extension request to the Tax Division on or before the original due date of the return. The extended due date of

the municipal income tax return shall be the last day of the month following the month to which the due date of the federal

income tax return has been extended.

No penalty shall be assessed in those cases in which the return is filed and the final tax paid within the extension period

provided all other filing and payment requirements of the Income Tax Code have been met. Interest accrues on any tax due

on the return from the original due date of the return until the date the tax is paid. Please call the Kettering Tax Division

at (937) 296-2502 for the current interest rate. If it becomes evident upon further examination that declaration filing and

payment requirements of the Income Tax Code have not been fulfilled, penalty and interest may be assessed in full and in the

same manner as though no extension had been granted.

File duplicate copies of your federal extension request and this application along with a self-addressed, stamped envelope

with the City of Kettering, Tax Division, P.O. Box 293100, Kettering, Ohio 45429-9100. One of the copies, indicating approval

(or disapproval) will be returned to the taxpayer or the agent making the request. This copy should be attached to the income

tax return when filed. The income tax return may be filed any time on or before the extended due date.

1

1