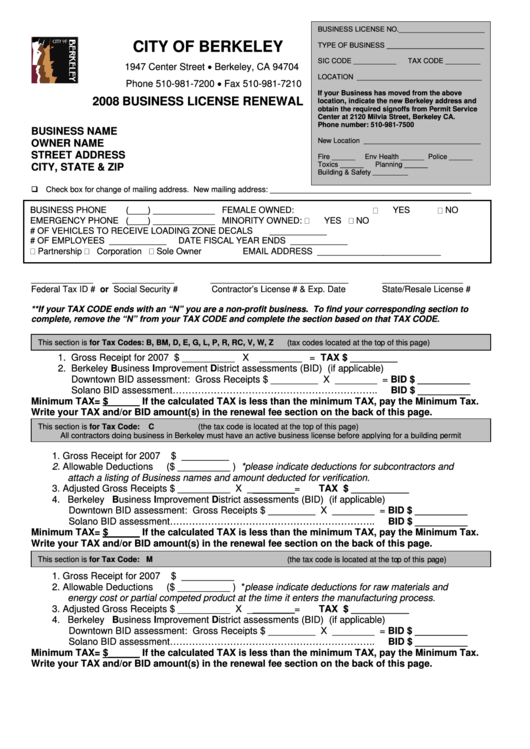

2008 Business License Renewal Form - City Of Berkeley, California

ADVERTISEMENT

BUSINESS LICENSE NO.______________________

CITY OF BERKELEY

TYPE OF BUSINESS _________________________

SIC CODE ___________

TAX CODE _________

1947 Center Street • Berkeley, CA 94704

LOCATION ________________________________

Phone 510-981-7200 • Fax 510-981-7210

If your Business has moved from the above

2008 BUSINESS LICENSE RENEWAL

location, indicate the new Berkeley address and

obtain the required signoffs from Permit Service

Center at 2120 Milvia Street, Berkeley CA.

Phone number: 510-981-7500

BUSINESS NAME

New Location ______________________________

OWNER NAME

STREET ADDRESS

Fire ______

Env Health ______ Police ______

Toxics ______

Planning ______

CITY, STATE & ZIP

Building & Safety __________

Check box for change of mailing address. New mailing address: ______________________________________________

BUSINESS PHONE

(____) _____________

FEMALE OWNED:

YES

NO

EMERGENCY PHONE (____) _____________

MINORITY OWNED:

YES

NO

# OF VEHICLES TO RECEIVE LOADING ZONE DECALS

____________

# OF EMPLOYEES ____________

DATE FISCAL YEAR ENDS ____________

Partnership

Corporation

Sole Owner

EMAIL ADDRESS __________________________

_____________

_____________

_____________________________

_________________

Federal Tax ID # or Social Security #

Contractor’s License # & Exp. Date

State/Resale License #

**If your TAX CODE ends with an “N” you are a non-profit business. To find your corresponding section to

complete, remove the “N” from your TAX CODE and complete the section based on that TAX CODE.

This section is for Tax Codes: B, BM, D, E, G, L, P, R, RC, V, W, Z

(tax codes located at the top of this page)

1. Gross Receipt for 2007 $ __________ X

________ = TAX $ _________

2. Berkeley Business Improvement District assessments (BID) (if applicable)

Downtown BID assessment: Gross Receipts $ _________ X ________ = BID $ __________

Solano BID assessment………………………………………………………..

BID $ __________

Minimum TAX= $______ If the calculated TAX is less than the minimum TAX, pay the Minimum Tax.

Write your TAX and/or BID amount(s) in the renewal fee section on the back of this page.

This section is for Tax Code:

C

(the tax code is located at the top of this page)

All contractors doing business in Berkeley must have an active business license before applying for a building permit

1. Gross Receipt for 2007

$ _________

2. Allowable Deductions

($ __________ ) *please indicate deductions for subcontractors and

attach a listing of Business names and amount deducted for verification.

3. Adjusted Gross Receipts $ __________ X ________ =

TAX $ ___________

4. Berkeley Business Improvement District assessments (BID) (if applicable)

Downtown BID assessment: Gross Receipts $ _________ X ________ = BID $ __________

Solano BID assessment………………………………………………………..

BID $ __________

Minimum TAX= $______ If the calculated TAX is less than the minimum TAX, pay the Minimum Tax.

Write your TAX and/or BID amount(s) in the renewal fee section on the back of this page.

This section is for Tax Code: M

(the tax code is located at the top of this page)

1. Gross Receipt for 2007

$ __________

2. Allowable Deductions

($ __________ ) *please indicate deductions for raw materials and

energy cost or partial competed product at the time it enters the manufacturing process.

3. Adjusted Gross Receipts $ __________ X ________ =

TAX $ ___________

4. Berkeley Business Improvement District assessments (BID) (if applicable)

Downtown BID assessment: Gross Receipts $ _________ X ________ = BID $ __________

Solano BID assessment………………………………………………………..

BID $ __________

Minimum TAX= $______ If the calculated TAX is less than the minimum TAX, pay the Minimum Tax.

Write your TAX and/or BID amount(s) in the renewal fee section on the back of this page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2