Form Cot/st-118 - Instructions For Completing The Maryland Sales And Use Tax Report - 1998

ADVERTISEMENT

FORM INCOMPLETE. DO NOT FILE.

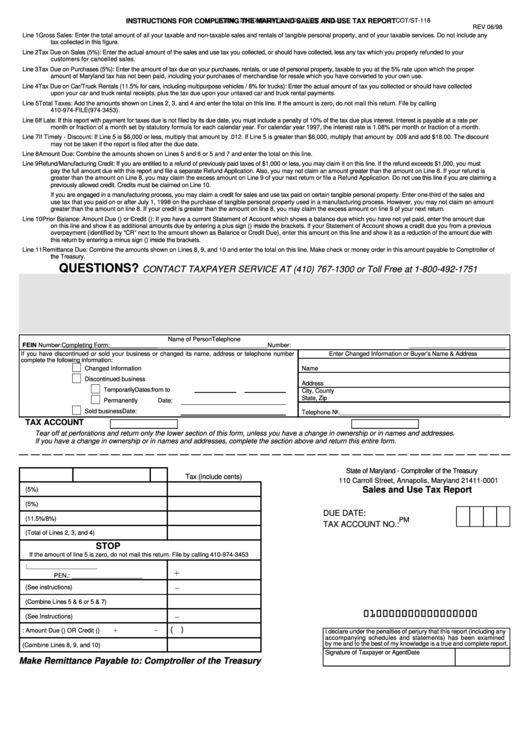

INSTRUCTIONS FOR COMPLETING THE MARYLAND SALES AND USE TAX REPORT

COT/ST-118

REV 06/98

Line 1

Gross Sales: Enter the total amount of all your taxable and non-taxable sales and rentals of tangible personal property, and of your taxable services. Do not include any

tax collected in this figure.

Line 2

Tax Due on Sales (5%): Enter the actual amount of the sales and use tax you collected, or should have collected, less any tax which you properly refunded to your

customers for cancelled sales.

Line 3

Tax Due on Purchases (5%): Enter the amount of tax due on your purchases, rentals, or use of personal property, taxable to you at the 5% rate upon which the proper

amount of Maryland tax has not been paid, including your purchases of merchandise for resale which you have converted to your own use.

Line 4

Tax Due on Car/Truck Rentals (11.5% for cars, including multipurpose vehicles / 8% for trucks): Enter the actual amount of tax you collected or should have collected

upon your car and truck rental receipts, plus the tax due upon your untaxed car and truck rental payments.

Line 5

Total Taxes: Add the amounts shown on Lines 2, 3, and 4 and enter the total on this line. If the amount is zero, do not mail this return. File by calling

410-974-FILE(974-3453).

Line 6

If Late: If this report with payment for taxes due is not filed by its due date, you must include a penalty of 10% of the tax due plus interest. Interest is payable at a rate per

month or fraction of a month set by statutory formula for each calendar year. For calendar year 1997, the interest rate is 1.08% per month or fraction of a month.

Line 7

If Timely - Discount: If Line 5 is $6,000 or less, multiply that amount by .012. If Line 5 is greater than $6,000, multiply that amount by .009 and add $18.00. The discount

may not be taken if the report is filed after the due date.

Line 8

Amount Due: Combine the amounts shown on Lines 5 and 6 or 5 and 7 and enter the total on this line.

Line 9

Refund/Manufacturing Credit: If you are entitled to a refund of previously paid taxes of $1,000 or less, you may claim it on this line. If the refund exceeds $1,000, you must

pay the full amount due with this report and file a separate Refund Application. Also, you may not claim an amount greater than the amount on Line 8. If your refund is

greater than the amount on Line 8, you may claim the excess amount on Line 9 of your next return or file a Refund Application. Do not use this line if you are claiming a

previously allowed credit. Credits must be claimed on Line 10.

If you are engaged in a manufacturing process, you may claim a credit for sales and use tax paid on certain tangible personal property. Enter one-third of the sales and

use tax that you paid on or after July 1, 1998 on the purchase of tangible personal property used in a manufacturing process. However, you may not claim an amount

greater than the amount on line 8. If your credit is greater than the amount on line 8, you may claim the excess amount on line 9 of your next return.

Line 10

Prior Balance: Amount Due ( ) or Credit ( ): If you have a current Statement of Account which shows a balance due which you have not yet paid, enter the amount due

on this line and show it as additional amounts due by entering a plus sign ( ) inside the brackets. If your Statement of Account shows a credit due you from a previous

overpayment (identified by “CR” next to the amount shown as Balance or Credit Due), enter this amount on this line and show it as a reduction of the amount due with

this return by entering a minus sign ( ) inside the brackets.

Line 11

Remittance Due: Combine the amounts shown on Lines 8, 9, and 10 and enter the total on this line. Make check or money order in this amount payable to Comptroller of

the Treasury.

QUESTIONS?

CONTACT TAXPAYER SERVICE AT (410) 767-1300 or Toll Free at 1-800-492-1751

Name of Person

Telephone

FEIN Number:

Completing Form: ______________________________________________

Number:

________________________________

_________________________________

If you have discontinued or sold your business or changed its name, address or telephone number

Enter Changed Information or Buyer’s Name & Address

complete the following information:

7

Changed Information

Name

7

Discontinued business

7

Address

Temporarily

Dates: from

to

City, County

7

State, Zip

Permanently

Date:

7

Sold business

Date:

Telephone No.

_______________________________________________________

TAX ACCOUNT NO.

RETURN PERIOD

Tear off at perforations and return only the lower section of this form, unless you have a change in ownership or in names and addresses.

If you have a change in ownership or in names and addresses, complete the section above and return this entire form.

State of Maryland - Comptroller of the Treasury

1. Gross Sales

00

Tax (include cents)

110 Carroll Street, Annapolis, Maryland 21411-0001

Sales and Use Tax Report

2. Tax Due on Sales (5%)

3. Tax Due on Purchases (5%)

DUE DATE:

4. Tax Due on Car/Truck Rentals (11.5%/8%)

PM

TAX ACCOUNT NO.:

5. Total Taxes (Total of Lines 2, 3, and 4)

STOP

If the amount of line 5 is zero, do not mail this return. File by calling 410-974-3453

6. If Late - INT.:

________________________

PEN.:

________________________

7. If Timely - Discount (See instructions)

8. Amount Due (Combine Lines 5 & 6 or 5 & 7)

9. Refund Due (See Instructions)

( )

10. Prior Balance: Amount Due ( ) OR Credit ( )

I declare under the penalties of perjury that this report (including any

accompanying schedules and statements) has been examined

by me and to the best of my knowledge is a true and complete report.

11. Remittance Due (Combine Lines 8, 9, and 10)

Signature of Taxpayer or Agent

Date

Make Remittance Payable to: Comptroller of the Treasury

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1