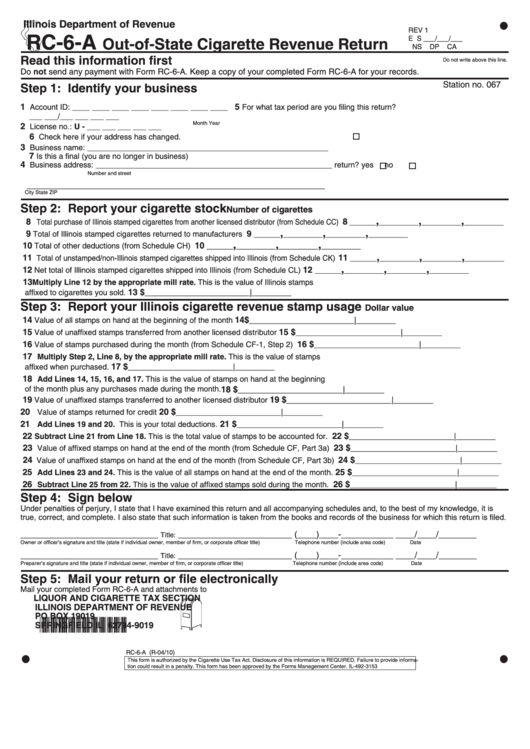

Form Rc-6-A - Out-Of-State Cigarette Revenue Return

ADVERTISEMENT

Illinois Department of Revenue

REV 1

RC-6-A

Out-of-State Cigarette Revenue Return

E S ___/___/___

NS

DP

CA

Read this information first

Do not write above this line.

Do not send any payment with Form RC-6-A. Keep a copy of your completed Form RC-6-A for your records.

Station no. 067

Step 1: Identify your business

1

5

Account ID: ____ ____ ____ ____ ____ ____ ____ ____

For what tax period are you filing this return?

___ ___/___ ___ ___ ___

Month

Year

2

License no.: U - ___ ___ ___ ___ ___

6

Check here if your address has changed.

3

Business name: _______________________________________________________

7

Is this a final (you are no longer in business)

4

Business address: ______________________________________________________

return?

yes

no

Number and street

____________________________________________________________________

City

State

ZIP

Step 2: Report your cigarette stock

Number of cigarettes

,

,

,

8

8

Total purchase of Illinois stamped cigarettes from another licensed distributor (from Schedule CC)

______

_________

_________

_________

,

,

,

9

9

Total of Illinois stamped cigarettes returned to manufacturers

______

_________

_________

_________

,

,

,

10

10

Total of other deductions (from Schedule CH)

______

_________

_________

_________

,

,

,

11

11

Total of unstamped/non-Illinois stamped cigarettes shipped into Illinois (from Schedule CK)

______

_________

_________

_________

,

,

,

12

12

Net total of Illinois stamped cigarettes shipped into Illinois (from Schedule CL)

______

_________

_________

_________

1 3

Multiply Line 12 by the appropriate mill rate. This is the value of Illinois stamps

13 $

affixed to cigarettes you sold.

________________________|_________

Step 3: Report your Illinois cigarette revenue stamp usage

Dollar value

14

14

$

Value of all stamps on hand at the beginning of the month

________________________|_________

15

15 $

Value of unaffixed stamps transferred from another licensed distributor

________________________|_________

16

16 $

Value of stamps purchased during the month (from Schedule CF-1, Step 2)

________________________|_________

17

Multiply Step 2, Line 8, by the appropriate mill rate. This is the value of stamps

17 $

affixed when purchased.

________________________|_________

18

Add Lines 14, 15, 16, and 17. This is the value of stamps on hand at the beginning

of the month plus any purchases made during the month.

18 $

________________________|_________

19

19 $

Value of unaffixed stamps transferred to another licensed distributor

________________________|_________

20

20 $

Value of stamps returned for credit

________________________|_________

21

21 $

Add Lines 19 and 20. This is your total deductions.

________________________|_________

22

22 $

Subtract Line 21 from Line 18. This is the total value of stamps to be accounted for.

________________________|_________

2 3

23 $

Value of affixed stamps on hand at the end of the month (from Schedule CF, Part 3a)

________________________|_________

2 4

24 $

Value of unaffixed stamps on hand at the end of the month (from Schedule CF, Part 3b)

________________________|_________

25

25 $

Add Lines 23 and 24. This is the value of all stamps on hand at the end of the month.

________________________|_________

26

26 $

Subtract Line 25 from 22. This is the value of affixed stamps sold during the month.

________________________|_________

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and all accompanying schedules and, to the best of my knowledge, it is

true, correct, and complete. I also state that such information is taken from the books and records of the business for which this return is filed.

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Owner or officer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

_____________________________

________________________ (____)____-___________ ____/____/________

Title:

Preparer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

Step 5: Mail your return or file electronically

Mail your completed Form RC-6-A and attachments to

LIQUOR AND CIGARETTE TAX SECTION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

*043301110*

SPRINGFIELD IL 62794-9019

RC-6-A (R-04/10)

This form is authorized by the Cigarette Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide informa-

tion could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2