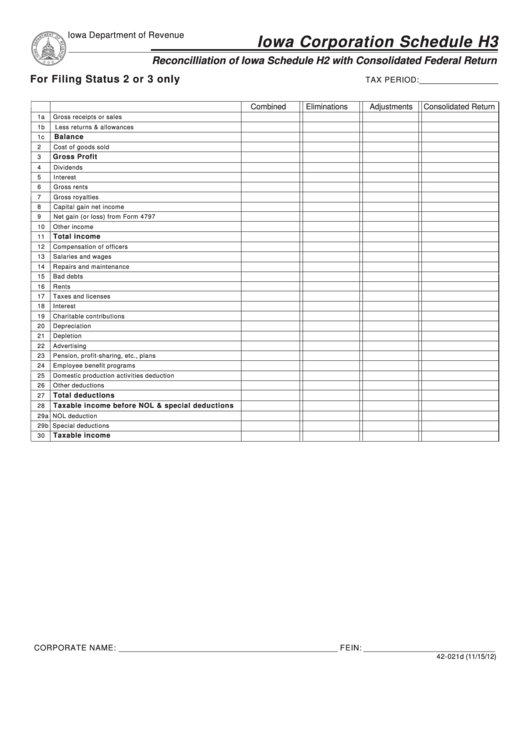

Form 42-021d - Iowa Corporation Schedule H3 (Reconcilliation Form Of Iowa Schedule H2 With Consolidated Federal Return)

ADVERTISEMENT

Iowa Department of Revenue

Iowa Corporation Schedule H3

Reconcilliation of Iowa Schedule H2 with Consolidated Federal Return

For Filing Status 2 or 3 only

TAX PERIOD: __________________

Combined

Eliminations

Adjustments

Consolidated Return

1a

Gross receipts or sales

1b

Less returns & allowances

Balance

1c

2

Cost of goods sold

Gross Profit

3

4

Dividends

5

Interest

6

Gross rents

7

Gross royalties

8

Capital gain net income

9

Net gain (or loss) from Form 4797

10

Other income

Total income

11

12

Compensation of officers

13

Salaries and wages

14

Repairs and maintenance

15

Bad debts

16

Rents

17

Taxes and licenses

18

Interest

19

Charitable contributions

20

Depreciation

21

Depletion

22

Advertising

23

Pension, profit-sharing, etc., plans

24

Employee benefit programs

25

Domestic production activities deduction

26

Other deductions

Total deductions

27

Taxable income before NOL & special deductions

28

29a NOL deduction

29b Special deductions

Taxable income

30

CORPORATE NAME: __________________________________________________ FEIN: ______________________________

42-021d (11/15/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1