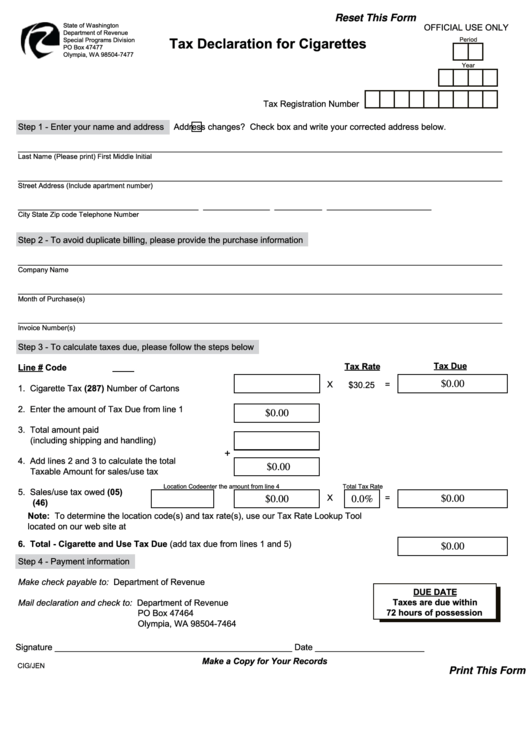

Reset This Form

State of Washington

OFFICIAL USE ONLY

Department of Revenue

Tax Declaration for Cigarettes

Period

Special Programs Division

PO Box 47477

Olympia, WA 98504-7477

Year

Tax Registration Number

Step 1 - Enter your name and address

Address changes? Check box and write your corrected address below.

______________________________________________________________________________________________________

Last Name (Please print)

First

Middle Initial

______________________________________________________________________________________________________

Street Address (Include apartment number)

______________________________________

______________

__________

______________________

City

State

Zip code

Telephone Number

Step 2 - To avoid duplicate billing, please provide the purchase information

______________________________________________________________________________________________________

Company Name

______________________________________________________________________________________________________

Month of Purchase(s)

______________________________________________________________________________________________________

Invoice Number(s)

Step 3 - To calculate taxes due, please follow the steps below

Tax Due

Tax Rate

Line #

Code

X

=

$30.25

$0.00

1. Cigarette Tax

(287)

Number of Cartons

2. Enter the amount of Tax Due from line 1

$0.00

3. Total amount paid

(including shipping and handling)

+

4. Add lines 2 and 3 to calculate the total

$0.00

Taxable Amount for sales/use tax

Location Code

enter the amount from line 4

Total Tax Rate

5. Sales/use tax owed

(05)

X

=

$0.00

$0.00

0.0%

(46)

Note: To determine the location code(s) and tax rate(s), use our Tax Rate Lookup Tool

located on our web site at dor.wa.gov. See page two for complete instructions.

6. Total - Cigarette and Use Tax Due (add tax due from lines 1 and 5)

$0.00

Step 4 - Payment information

Make check payable to: Department of Revenue

DUE DATE

Taxes are due within

Mail declaration and check to: Department of Revenue

72 hours of possession

PO Box 47464

Olympia, WA 98504-7464

Signature __________________________________________________

Date _______________________

Make a Copy for Your Records

CIG/JEN

Print This Form

1

1 2

2