Form Ct-1120a-Iric - Corporation Business Tax Return Apportionment Computation Of Income From Services To Regulated Investment Companies - State Of Connecticut - Department Of Revenue Services - 2012

ADVERTISEMENT

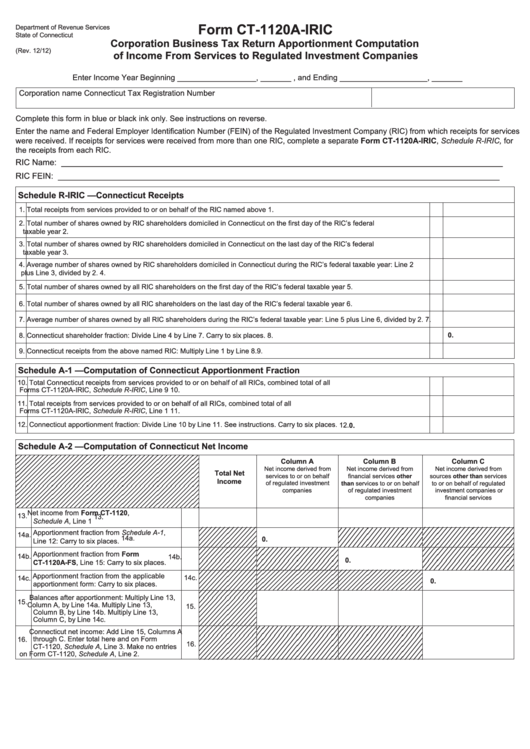

Form CT-1120A-IRIC

Department of Revenue Services

State of Connecticut

Corporation Business Tax Return Apportionment Computation

(Rev. 12/12)

of Income From Services to Regulated Investment Companies

Enter Income Year Beginning __________________, _______ , and Ending ____________________, _______

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only. See instructions on reverse.

Enter the name and Federal Employer Identification Number (FEIN) of the Regulated Investment Company (RIC) from which receipts for services

were received. If receipts for services were received from more than one RIC, complete a separate Form CT-1120A-IRIC, Schedule R-IRIC, for

the receipts from each RIC.

RIC Name:

_____________________________________________________________________________________________

_____________________________________________________________________________________________

RIC FEIN:

Schedule R-IRIC — Connecticut Receipts

1. Total receipts from services provided to or on behalf of the RIC named above

1.

2. Total number of shares owned by RIC shareholders domiciled in Connecticut on the first day of the RIC’s federal

taxable year

2.

3. Total number of shares owned by RIC shareholders domiciled in Connecticut on the last day of the RIC’s federal

taxable year

3.

4. Average number of shares owned by RIC shareholders domiciled in Connecticut during the RIC’s federal taxable year: Line 2

plus Line 3, divided by 2.

4.

5. Total number of shares owned by all RIC shareholders on the first day of the RIC’s federal taxable year

5.

6. Total number of shares owned by all RIC shareholders on the last day of the RIC’s federal taxable year

6.

7. Average number of shares owned by all RIC shareholders during the RIC’s federal taxable year: Line 5 plus Line 6, divided by 2.

7.

8. Connecticut shareholder fraction: Divide Line 4 by Line 7. Carry to six places.

8.

0.

9. Connecticut receipts from the above named RIC: Multiply Line 1 by Line 8.

9.

Schedule A-1 — Computation of Connecticut Apportionment Fraction

10. Total Connecticut receipts from services provided to or on behalf of all RICs, combined total of all

Forms CT-1120A-IRIC, Schedule R-IRIC, Line 9

10.

11. Total receipts from services provided to or on behalf of all RICs, combined total of all

Forms CT-1120A-IRIC, Schedule R-IRIC, Line 1

11.

12. Connecticut apportionment fraction: Divide Line 10 by Line 11. See instructions. Carry to six places.

12.

0.

Schedule A-2 — Computation of Connecticut Net Income

Column A

Column B

Column C

Net income derived from

Net income derived from

Net income derived from

Total Net

services to or on behalf

financial services other

sources other than services

Income

of regulated investment

than services to or on behalf

to or on behalf of regulated

companies

of regulated investment

investment companies or

companies

financial services

13. Net income from Form CT-1120,

13.

Schedule A, Line 1

14a. Apportionment fraction from Schedule A-1,

14a.

0.

Line 12: Carry to six places.

14b. Apportionment fraction from Form

14b.

0.

CT-1120A-FS, Line 15: Carry to six places.

14c. Apportionment fraction from the applicable

14c.

0.

apportionment form: Carry to six places.

Balances after apportionment: Multiply Line 13,

15.

Column A, by Line 14a. Multiply Line 13,

15.

Column B, by Line 14b. Multiply Line 13,

Column C, by Line 14c.

Connecticut net income: Add Line 15, Columns A

16.

through C. Enter total here and on Form

16.

CT-1120, Schedule A, Line 3. Make no entries

on Form CT-1120, Schedule A, Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1