Form Dr 0137 - Claim For Refund

ADVERTISEMENT

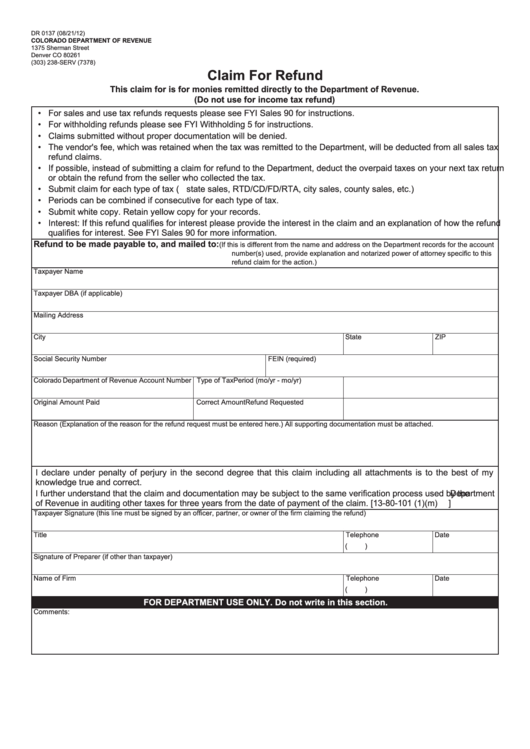

DR 0137 (08/21/12)

COLORADO DEPARTMENT OF REVENUE

1375 Sherman Street

Denver CO 80261

(303) 238-SERV (7378)

Claim For Refund

This claim for is for monies remitted directly to the Department of Revenue.

(Do not use for income tax refund)

• For sales and use tax refunds requests please see FYI Sales 90 for instructions.

• For withholding refunds please see FYI Withholding 5 for instructions.

• Claims submitted without proper documentation will be denied.

• The vendor's fee, which was retained when the tax was remitted to the Department, will be deducted from all sales tax

refund claims.

• If possible, instead of submitting a claim for refund to the Department, deduct the overpaid taxes on your next tax return

or obtain the refund from the seller who collected the tax.

• Submit claim for each type of tax (e.g. state sales, RTD/CD/FD/RTA, city sales, county sales, etc.)

• Periods can be combined if consecutive for each type of tax.

• Submit white copy. Retain yellow copy for your records.

• Interest: If this refund qualifies for interest please provide the interest in the claim and an explanation of how the refund

qualifies for interest. See FYI Sales 90 for more information.

Refund to be made payable to, and mailed to:

(If this is different from the name and address on the Department records for the account

number(s) used, provide explanation and notarized power of attorney specific to this

refund claim for the action.)

Taxpayer Name

Taxpayer DBA (if applicable)

Mailing Address

City

State

ZIP

Social Security Number

FEIN (required)

Colorado Department of Revenue Account Number Type of Tax

Period (mo/yr - mo/yr)

Original Amount Paid

Correct Amount

Refund Requested

Reason (Explanation of the reason for the refund request must be entered here.) All supporting documentation must be attached.

I declare under penalty of perjury in the second degree that this claim including all attachments is to the best of my

knowledge true and correct.

I further understand that the claim and documentation may be subject to the same verification process used by the Department

of Revenue in auditing other taxes for three years from the date of payment of the claim. [13-80-101 (1)(m) C.R.S.]

Taxpayer Signature (this line must be signed by an officer, partner, or owner of the firm claiming the refund)

Title

Telephone

Date

(

)

Signature of Preparer (if other than taxpayer)

Name of Firm

Telephone

Date

(

)

FOR DEPARTMENT USE ONLY. Do not write in this section.

Comments:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1