Retiree Refund Claim Form - Arkansas Individual Income Tax

ADVERTISEMENT

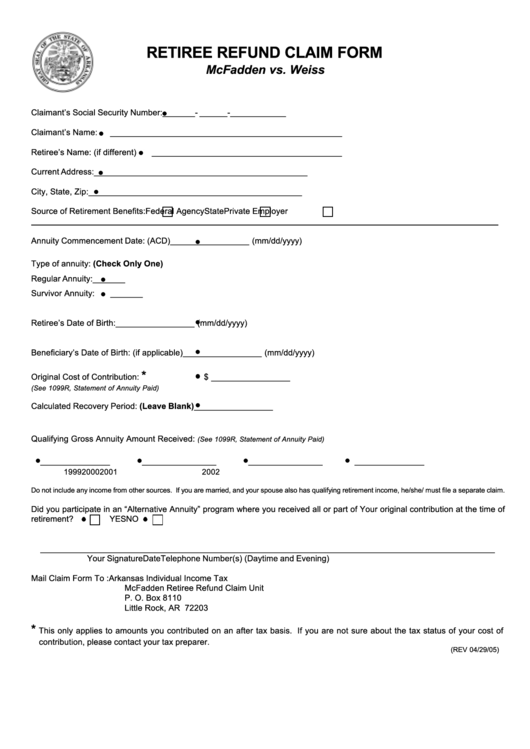

RETIREE REFUND CLAIM FORM

McFadden vs. Weiss

Claimant’s Social Security Number:

_______ - ______ - ____________

Claimant’s Name:

__________________________________________________

Retiree’s Name: (if different)

_________________________________________

Current Address:

______________________________________________

City, State, Zip:

______________________________________________

Source of Retirement Benefits:

Federal Agency

State

Private Employer

Annuity Commencement Date: (ACD)

_________________ (mm/dd/yyyy)

Type of annuity: (Check Only One)

Regular Annuity:

_______

Survivor Annuity:

_______

Retiree’s Date of Birth:

_________________ (mm/dd/yyyy)

Beneficiary’s Date of Birth: (if applicable)

_________________ (mm/dd/yyyy)

*

Original Cost of Contribution:

$ _________________

(See 1099R, Statement of Annuity Paid)

Calculated Recovery Period: (Leave Blank)

_________________

Qualifying Gross Annuity Amount Received:

(See 1099R, Statement of Annuity Paid)

_______________

________________

________________

_______________

1999

2000

2001

2002

Do not include any income from other sources. If you are married, and your spouse also has qualifying retirement income, he/she/ must file a separate claim.

Did you participate in an “Alternative Annuity” program where you received all or part of Your original contribution at the time of

retirement?

YES

NO

__________________________________________________________________________________________________

Your Signature

Date

Telephone Number(s) (Daytime and Evening)

Mail Claim Form To :

Arkansas Individual Income Tax

McFadden Retiree Refund Claim Unit

P. O. Box 8110

Little Rock, AR 72203

*

This only applies to amounts you contributed on an after tax basis. If you are not sure about the tax status of your cost of

contribution, please contact your tax preparer.

(REV 04/29/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1