RESET FORM

A

D

R

USE FOR THIS

LABAMA

EPARTMENT OF

EVENUE

TAX YEAR ONLY

FORM

I

& C

T

D

NDIVIDUAL

ORPORATE

AX

IVISION

2006

2300

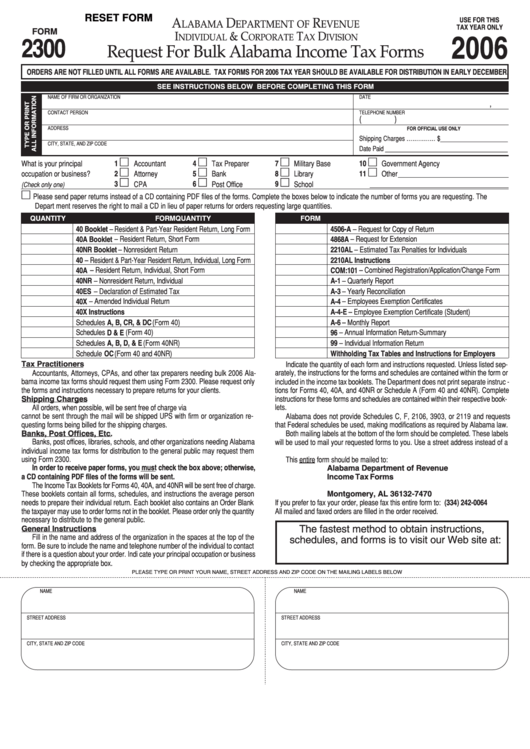

Request For Bulk Alabama Income Tax Forms

ORDERS ARE NOT FILLED UNTIL ALL FORMS ARE AVAILABLE. TAX FORMS FOR 2006 TAX YEAR SHOULD BE AVAILABLE FOR DISTRIBUTION IN EARLY DECEMBER.

SEE INSTRUCTIONS BELOW BEFORE COMPLETING THIS FORM

NAME OF FIRM OR ORGANIZATION

DATE

,

CONTACT PERSON

TELEPHONE NUMBER

(

)

ADDRESS

FOR OFFICIAL USE ONLY

Shipping Charges …………… $_____________________

CITY, STATE, AND ZIP CODE

Date Paid _______________________________________

What is your principal

1

Accountant

4

Tax Preparer

7

Military Base

10

Government Agency

occupation or business?

2

Attorney

5

Bank

8

Library

11

Other

3

CPA

6

Post Office

9

School

(Check only one)

Please send paper returns instead of a CD containing PDF files of the forms. Complete the boxes below to indicate the number of forms you are requesting. The

Depart ment reserves the right to mail a CD in lieu of paper returns for orders requesting large quantities.

QUANTITY

FORM

QUANTITY

FORM

40 Booklet – Resident & Part-Year Resident Return, Long Form

4506-A – Request for Copy of Return

40A Booklet – Resident Return, Short Form

4868A – Request for Extension

40NR Booklet – Nonresident Return

2210AL – Estimated Tax Penalties for Individuals

40 – Resident & Part-Year Resident Return, Individual, Long Form

2210AL Instructions

40A – Resident Return, Individual, Short Form

COM:101 – Combined Registration/Application/Change Form

40NR – Nonresident Return, Individual

A-1 – Quarterly Report

40ES – Declaration of Estimated Tax

A-3 – Yearly Reconciliation

40X – Amended Individual Return

A-4 – Employees Exemption Certificates

40X Instructions

A-4-E – Employee Exemption Certificate (Student)

Schedules A, B, CR, & DC (Form 40)

A-6 – Monthly Report

Schedules D & E (Form 40)

96 – Annual Information Return-Summary

Schedules A, B, D, & E (Form 40NR)

99 – Individual Information Return

Schedule OC (Form 40 and 40NR)

Withholding Tax Tables and Instructions for Employers

Tax Practitioners

Indicate the quantity of each form and instructions requested. Unless listed sep-

Accountants, Attorneys, CPAs, and other tax preparers needing bulk 2006 Ala-

arately, the instructions for the forms and schedules are contained within the form or

bama income tax forms should request them using Form 2300. Please request only

included in the income tax booklets. The Department does not print separate instruc -

the forms and instructions necessary to prepare returns for your clients.

tions for Forms 40, 40A, and 40NR or Schedule A (Form 40 and 40NR). Complete

Shipping Charges

instructions for these forms and schedules are contained within their respective book-

All orders, when possible, will be sent free of charge via U.S. mail. Orders which

lets.

cannot be sent through the mail will be shipped UPS with firm or organization re-

Alabama does not provide Schedules C, F, 2106, 3903, or 2119 and requests

questing forms being billed for the shipping charges.

that Federal schedules be used, making modifications as required by Alabama law.

Banks, Post Offices, Etc.

Both mailing labels at the bottom of the form should be completed. These labels

Banks, post offices, libraries, schools, and other organizations needing Alabama

will be used to mail your requested forms to you. Use a street address instead of a

individual income tax forms for distribution to the general public may request them

P.O. Box number when filling out the labels.

using Form 2300.

This entire form should be mailed to:

In order to receive paper forms, you must check the box above; otherwise,

Alabama Department of Revenue

a CD containing PDF files of the forms will be sent.

Income Tax Forms

The Income Tax Booklets for Forms 40, 40A, and 40NR will be sent free of charge.

P.O. Box 327470

These booklets contain all forms, schedules, and instructions the average person

Montgomery, AL 36132-7470

needs to prepare their individual return. Each booklet also contains an Order Blank

If you prefer to fax your order, please fax this entire form to: (334) 242-0064

the taxpayer may use to order forms not in the booklet. Please order only the quantity

All mailed and faxed orders are filled in the order received.

necessary to distribute to the general public.

The fastest method to obtain instructions,

General Instructions

Fill in the name and address of the organization in the spaces at the top of the

schedules, and forms is to visit our Web site at:

form. Be sure to include the name and telephone number of the individual to contact

if there is a question about your order. Indi cate your principal occupation or business

by checking the appropriate box.

PLEASE TYPE OR PRINT YOUR NAME, STREET ADDRESS AND ZIP CODE ON THE MAILING LABELS BELOW

NAME

NAME

STREET ADDRESS

STREET ADDRESS

CITY, STATE AND ZIP CODE

CITY, STATE AND ZIP CODE

1

1