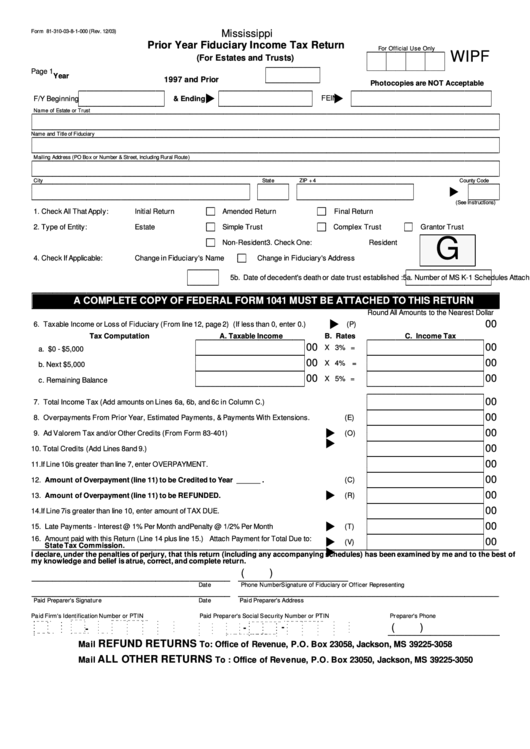

Form 81-310-03-8-1-000 - Prior Year Fiduciary Income Tax Return For Estates And Trusts - Ms Office Of Revenue - 2003

ADVERTISEMENT

Form 81-310-03-8-1-000 (Rev. 12/03)

Mississippi

Prior Year Fiduciary Income Tax Return

For Official Use Only

WIPF

(For Estates and Trusts)

Page 1

Year

1997 and Prior

Photocopies are NOT Acceptable

FEIN

F/Y Beginning

& Ending

Name of Estate or Trust

Name and Title of Fiduciary

Mailing Address (PO Box or Number & Street, Including Rural Route)

City

State

ZIP + 4

County Code

(See Instructions)

1. Check All That Apply:

Initial Return

Amended Return

Final Return

2. Type of Entity:

Estate

Simple Trust

Complex Trust

Grantor Trust

G

3. Check One:

Resident

Non-Resident

4. Check If Applicable:

Change in Fiduciary's Name

Change in Fiduciary's Address

5a. Number of MS K-1 Schedules Attached:

5b. Date of decedent's death or date trust established :

A COMPLETE COPY OF FEDERAL FORM 1041 MUST BE ATTACHED TO THIS RETURN

Round All Amounts to the Nearest Dollar

00

6. Taxable Income or Loss of Fiduciary (From line 12, page 2) (If less than 0, enter 0.)

(P)

Tax Computation

A. Taxable Income

B. Rates

C. Income Tax

00

00

X 3% =

a. $0 - $5,000

00

00

X

4%

=

b. Next $5,000

00

00

X 5%

=

c. Remaining Balance

00

7. Total Income Tax (Add amounts on Lines 6a, 6b, and 6c in Column C.)

00

8. Overpayments From Prior Year, Estimated Payments, & Payments With Extensions.

(E)

00

9. Ad Valorem Tax and/or Other Credits (From Form 83-401)

(O)

00

10. Total Credits (Add Lines 8 and 9.)

00

11. If Line 10 is greater than line 7, enter OVERPAYMENT.

00

12. Amount of Overpayment (line 11) to be Credited to Year ______ .

(C)

00

13. Amount of Overpayment (line 11) to be REFUNDED.

(R)

00

14. If Line 7 is greater than line 10, enter amount of TAX DUE.

00

15. Late Payments - Interest @ 1% Per Month and Penalty @ 1/2% Per Month

(T)

16. Amount paid with this Return (Line 14 plus line 15.) Attach Payment for Total Due to:

00

(V)

State Tax Commission.

I declare, under the penalties of perjury, that this return (including any accompanying schedules) has been examined by me and to the best of

my knowledge and belief is a true, correct, and complete return.

(

)

S ignature of Fiduciary or Officer Rep resentin g

Date

Phone Number

Paid Prep arer's Sign atur e

Date

Pai d Pre parer's Ad dress

Pa id Firm's Ide ntificatio n Number or PTIN

Paid Prepar er's Social S ecu rity Number or PTIN

Pr eparer's Ph one

. . . . . . . . . . . . . .

.

. . . . . . . . . . . . . . . . .

. . . . . . . .

.

.

.

.

.

. . . . . . . . . . .

. . . . . . . . . . . . . . . . .

.

.

.

.

.

.

. . . . . . . . . . . . . .

. . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(

)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

-

.

.

.

.

-

.

-

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. . . . . . . . .

. . . . . . . .

. . . .

.

.

.

.

.

.

.

.

.

.

. . . . . . . . . . . . . . . . .

.

.

.

.

. . . . . . . . . .

. . . . .

. . . . . . . . .

. . . . . . . .

.

. . . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

REFUND RETURNS

Mail

To: Office of Revenue, P.O. Box 23058, Jackson, MS 39225-3058

ALL OTHER RETURNS

Mail

To : Office of Revenue, P.O. Box 23050, Jackson, MS 39225-3050

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2