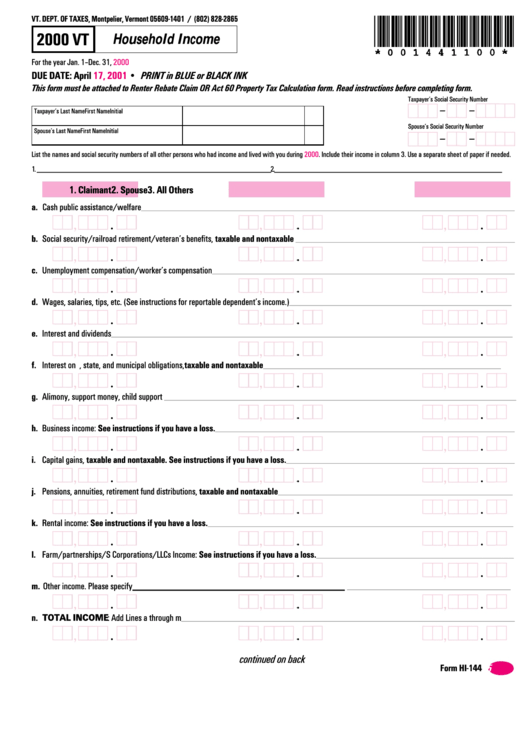

Form Hi-144 - Vt Household Income - 2000

ADVERTISEMENT

VT. DEPT. OF TAXES, Montpelier, Vermont 05609-1401 / (802) 828-2865

2000 VT

Household Income

For the year Jan. 1–Dec. 31,

2000

DUE DATE: April

17, 2001

• PRINT in BLUE or BLACK INK

This form must be attached to Renter Rebate Claim OR Act 60 Property Tax Calculation form. Read instructions before completing form.

Taxpayer’s Social Security Number

Taxpayer’s Last Name

First Name

Initial

Spouse’s Social Security Number

Spouse’s Last Name

First Name

Initial

List the names and social security numbers of all other persons who had income and lived with you during 2000. Include their income in column 3. Use a separate sheet of paper if needed.

1. ________________________________________________________________________

2. ______________________________________________________________________

1. Claimant

2. Spouse

3. All Others

a. Cash public assistance/welfare

_________________________________________________________________________________________________________________________

a.

a.

a.

b. Social security/railroad retirement/veteran’s benefits, taxable and nontaxable

_______________________________________________________________________

b.

b.

b.

c. Unemployment compensation/worker’s compensation

__________________________________________________________________________________________________

c.

c.

c.

d. Wages, salaries, tips, etc. (See instructions for reportable dependent’s income.)

________________________________________________________________________

d.

d.

d.

e. Interest and dividends

__________________________________________________________________________________________________________________________________

e.

e.

e.

f. Interest on U.S., state, and municipal obligations, taxable and nontaxable

_____________________________________________________________________________

f.

f.

f.

g. Alimony, support money, child support

__________________________________________________________________________________________________________________

g.

g.

g.

h. Business income: See instructions if you have a loss.

_________________________________________________________________________________________________

h.

h.

h.

i. Capital gains, taxable and nontaxable. See instructions if you have a loss.

__________________________________________________________________________

i.

i.

i.

j. Pensions, annuities, retirement fund distributions, taxable and nontaxable

____________________________________________________________________________

j.

j.

j.

k. Rental income: See instructions if you have a loss.

___________________________________________________________________________________________________

k.

k.

k.

l. Farm/partnerships/S Corporations/LLCs Income: See instructions if you have a loss.

________________________________________________________________

l.

l.

l.

m. Other income. Please specify ______________________________________________________

_____________________________________________________

m.

m.

m.

n. TOTAL INCOME: Add Lines a through m

____________________________________________________________________________________________________________

n.

n.

n.

continued on back

Form HI-144

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2