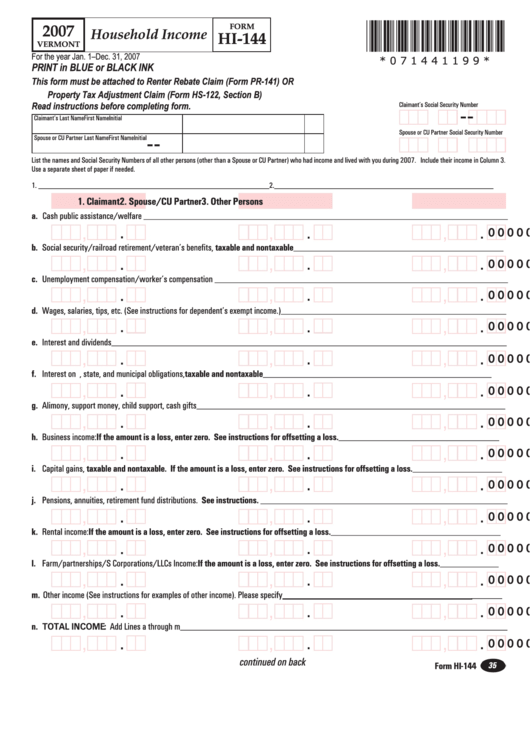

Vermont Form Hi-144 - Household Income - 2007

ADVERTISEMENT

*071441199*

FORM

2007

Household Income

HI-144

VERMONT

For the year Jan. 1– Dec. 31, 2007

* 0 7 1 4 4 1 1 9 9 *

PRINT in BLUE or BLACK INK

This form must be attached to Renter Rebate Claim (Form PR-141) OR

Property Tax Adjustment Claim (Form HS-122, Section B)

Claimant’s Social Security Number

Read instructions before completing form.

-

-

Claimant’s Last Name

First Name

Initial

Spouse or CU Partner Social Security Number

Spouse or CU Partner Last Name

First Name

Initial

-

-

List the names and Social Security Numbers of all other persons (other than a Spouse or CU Partner) who had income and lived with you during 2007. Include their income in Column 3.

Use a separate sheet of paper if needed.

1. ___________________________________________________________

2. ________________________________________________________

1. Claimant

2. Spouse/CU Partner

3. Other Persons

a. Cash public assistance/welfare

______________________________________________________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

a.

a.

a.

b. Social security/railroad retirement/veteran’s benefits, taxable and nontaxable

____________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

b.

b.

b.

c. Unemployment compensation/worker’s compensation

_______________________________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

c.

c.

c.

d. Wages, salaries, tips, etc. (See instructions for dependent’s exempt income.)

_________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

d.

d.

d.

e. Interest and dividends

________________________________________________________________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

e.

e.

e.

f. Interest on U.S., state, and municipal obligations, taxable and nontaxable

__________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

f.

f.

f.

g. Alimony, support money, child support, cash gifts

____________________________________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

g.

g.

g.

h. Business income: If the amount is a loss, enter zero. See instructions for offsetting a loss.

____________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

h.

h.

h.

i. Capital gains, taxable and nontaxable. If the amount is a loss, enter zero. See instructions for offsetting a loss.

_____________________________

.

.

.

,

,

,

0 0

0 0

0 0

i.

i.

i.

j. Pensions, annuities, retirement fund distributions. See instructions.

________________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

j.

j.

j.

k. Rental income: If the amount is a loss, enter zero. See instructions for offsetting a loss.

_______________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

k.

k.

k.

l. Farm/partnerships/S Corporations/LLCs Income: If the amount is a loss, enter zero. See instructions for offsetting a loss.

___________________

.

.

.

,

,

,

0 0

0 0

0 0

l.

l.

l.

m. Other income (See instructions for examples of other income). Please specify _________________________________________________

__________

.

.

.

,

,

,

0 0

0 0

0 0

m.

m.

m.

n. TOTAL INCOME: Add Lines a through m

__________________________________________________________________________________________________________

.

.

.

,

,

,

0 0

0 0

0 0

n.

n.

n.

continued on back

35

Form HI-144

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2