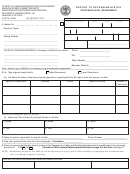

Form Lb-0443 - Report To Determine Status Page 2

ADVERTISEMENT

ELECTION TO BECOME A REIMBURSING EMPLOYER

Date _________________________

Pursuant to the provisions of Section 50-7-403(h) of the Tennessee Employment Security Law, the undersigned eligible

employer elects to reimburse the Tennessee Department of Labor and Workforce Development for all unemployment insurance

benefits (including the amount of extended benefits) charged to this legal entity during the effective period of election.

This employer elects to reimburse the Department of Labor and Workforce Development for benefits charged by one of the

two methods indicated below:

1. Monthly, the Department shall bill the employer for the amount equal to the full amount of regular benefits

plus one-half of extended benefits paid attributable to service in the employ of the employer. The employer

shall make full payment of the billed amount within thirty (30) days from the date the bill was mailed to the

employer, unless the employer has filed an application for a review and redetermination of such bill. If an

application for a review and redetermination has been filed, the employer must pay the bill in full within fifteen

(15) days of the final determination of this issue by the Department of Labor and Workforce Development.

or

2. Quarterly, the employer shall pay a percentage of its total payroll for the immediately preceding calendar year.

The percentage will be determined by the Department based on the employer’s average unemployment benefit

cost during the preceding calendar year. The Department will determine the percentage if the employer did not

pay wages in the preceding calendar year. At the end of the calendar year, the Department will determine

whether the total payments are less than or in excess of benefits chargeable to the employer during the calendar

year. If the payments are insufficient, the employer will be billed for the unpaid balance. If the payments are in

excess of benefit charges, the Department may, at its discretion, refund all or part of the excess or may retain all

or part as payment against charges expected to be incurred in the next calendar year.

This agreement is effective for a minimum of one complete taxable year. Any request to terminate this agreement and become

a premium-paying employer must be filed in writing with the Commissioner within thirty (30) days prior to the end of the then

current taxable year. (All taxable years end on June 30th.)

Agency __________________________________

By ______________________________________

Title _____________________________________

LB-0443 (R12/03) Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2