78-614 3/01 - Approved Lease Tax Worksheet

ADVERTISEMENT

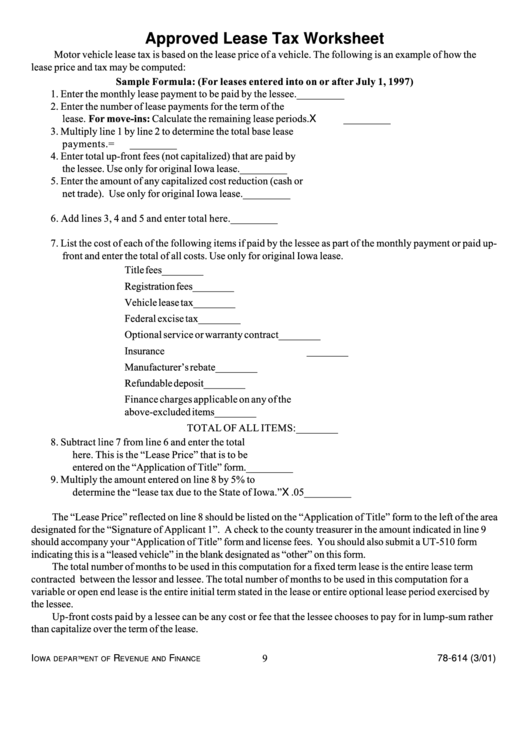

Approved Lease Tax Worksheet

Motor vehicle lease tax is based on the lease price of a vehicle. The following is an example of how the

lease price and tax may be computed:

Sample Formula: (For leases entered into on or after July 1, 1997)

1. Enter the monthly lease payment to be paid by the lessee.

_________

2. Enter the number of lease payments for the term of the

lease. For move-ins: Calculate the remaining lease periods. X

_________

3. Multiply line 1 by line 2 to determine the total base lease

payments.

=

_________

4. Enter total up-front fees (not capitalized) that are paid by

the lessee. Use only for original Iowa lease.

_________

5. Enter the amount of any capitalized cost reduction (cash or

net trade). Use only for original Iowa lease.

_________

6. Add lines 3, 4 and 5 and enter total here.

_________

7. List the cost of each of the following items if paid by the lessee as part of the monthly payment or paid up-

front and enter the total of all costs. Use only for original Iowa lease.

Title fees

________

Registration fees

________

Vehicle lease tax

________

Federal excise tax

________

Optional service or warranty contract

________

Insurance

________

Manufacturer’s rebate

________

Refundable deposit

________

Finance charges applicable on any of the

above-excluded items

________

TOTAL OF ALL ITEMS: ________

8. Subtract line 7 from line 6 and enter the total

here. This is the “Lease Price” that is to be

entered on the “Application of Title” form.

_________

9. Multiply the amount entered on line 8 by 5% to

determine the “lease tax due to the State of Iowa.”

X .05

_________

The “Lease Price” reflected on line 8 should be listed on the “Application of Title” form to the left of the area

designated for the “Signature of Applicant 1”. A check to the county treasurer in the amount indicated in line 9

should accompany your “Application of Title” form and license fees. You should also submit a UT-510 form

indicating this is a “leased vehicle” in the blank designated as “other” on this form.

The total number of months to be used in this computation for a fixed term lease is the entire lease term

contracted between the lessor and lessee. The total number of months to be used in this computation for a

variable or open end lease is the entire initial term stated in the lease or entire optional lease period exercised by

the lessee.

Up-front costs paid by a lessee can be any cost or fee that the lessee chooses to pay for in lump-sum rather

than capitalize over the term of the lease.

9

I

R

F

78-614 (3/01)

OWA DEPARTMENT OF

EVENUE AND

INANCE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2