City Of Brunswick Income Tax Return Form

ADVERTISEMENT

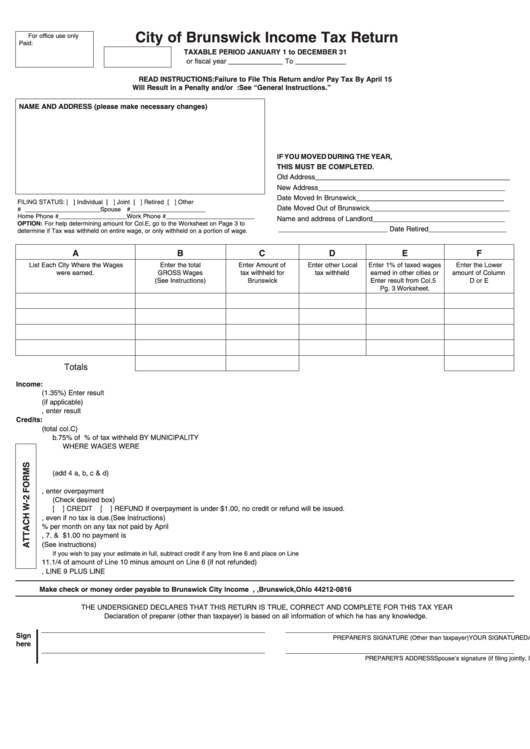

City of Brunswick Income Tax Return

For office use only

Paid:

TAXABLE PERIOD JANUARY 1 to DECEMBER 31

or fiscal year ______________ To _____________

READ INSTRUCTIONS: Failure to File This Return and/or Pay Tax By April 15

Will Result in a Penalty and/or Interest. EXTENSION: See “General Instructions.”

NAME AND ADDRESS (please make necessary changes)

IF YOU MOVED DURING THE YEAR,

THIS MUST BE COMPLETED.

Old Address __________________________________________________

New Address ________________________________________________

Date Moved In Brunswick ______________________________________

FILING STATUS: [ ] Individual [ ] Joint [ ] Retired [ ] Other

Date Moved Out of Brunswick ____________________________________

Soc. Sec. # ______________________ Spouse Soc. Sec. # ______________________

Home Phone # ____________________ Work Phone # __________________________

Name and address of Landlord __________________________________

OPTION: For help determining amount for Col. E, go to the Worksheet on Page 3 to

____________________________ Date Retired ____________________

determine if Tax was withheld on entire wage, or only withheld on a portion of wage.

A

B

C

D

E

F

List Each City Where the Wages

Enter the total

Enter Amount of

Enter other Local

Enter 1% of taxed wages

Enter the Lower

were earned.

GROSS Wages

tax withheld for

tax withheld

earned in other cities or

amount of Column

(See Instructions)

Brunswick

Enter result from Col. 5

D or E

Pg. 3 Worksheet.

Totals

Income:

1. Multiply total of column B by .0135 (1.35%) Enter result here....................................................................................................1. __________________

2. Enter total non-wage tax from Part VIII on page 2 (if applicable) ..............................................................................................2. __________________

3. Add lines 1 and 2, enter result here............................................................................................................................................3. __________________

Credits:

4. a. Tax withheld for Brunswick (total col. C)................................................................................................4a. ____________

b. 75% of amt. in col. F. Maximum amount allowed is 3/4 of up to 1% of tax withheld BY MUNICIPALITY

WHERE WAGES WERE EARNED. Proof of tax paid to another city must be submitted ....................4b. ____________

c. Payments made to Brunswick on declaration of estimated tax ............................................................4c. ____________

d. Any overpayment credit from prior year ................................................................................................4d. ____________

e. TOTAL CREDITS (add 4 a, b, c & d) ..................................................................................................................................4e. __________________

5. If amount on line 4e is LESS than the amount on line 3 subtract and enter the BALANCE DUE ............................................5. __________________

6. If amount on line 4e is GREATER than amount on line 3, enter overpayment here..................................6. ____________

(Check desired box)

[

] CREDIT

[

] REFUND If overpayment is under $1.00, no credit or refund will be issued.

7. Add PENALTY if filed and or paid after April 15th, even if no tax is due. (See Instructions)......................................................7. __________________

8. Add INTEREST at 2% per month on any tax not paid by April 15th ..........................................................................................8. __________________

9. TOTAL AMOUNT DUE add lines 5, 7, & 8. If balance due is less than $1.00 no payment is required ......................................9. __________________

10. ESTIMATED tax (See instructions)............................................................................................................10. ____________

If you wish to pay your estimate in full, subtract credit if any from line 6 and place on Line 11. OR if you rather pay quarterly go to Line 11.

11. 1/4 of amount of Line 10 minus amount on Line 6 (if not refunded) ........................................................................................11. __________________

12. AMOUNT paid with this return, LINE 9 PLUS LINE 11 ............................................................................................................12. __________________

Make check or money order payable to Brunswick City Income Tax. Mail to City of Brunswick, P.O. Box 0816, Brunswick, Ohio 44212-0816

THE UNDERSIGNED DECLARES THAT THIS RETURN IS TRUE, CORRECT AND COMPLETE FOR THIS TAX YEAR

Declaration of preparer (other than taxpayer) is based on all information of which he has any knowledge.

Sign

YOUR SIGNATURE

DATE

PREPARER’S SIGNATURE (Other than taxpayer)

here

Spouse’s signature (if filing jointly, BOTH must sign)

PREPARER’S ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3