Utility Tax Return Form - City Of Shoreline

ADVERTISEMENT

Mail Tax Returns and

Correspondence to:

City of Shoreline

City of Shoreline Finance Dept.

UTILITY TAX RETURN

17544 Midvale Ave. N.

Shoreline WA 98133

(206) 546-8737

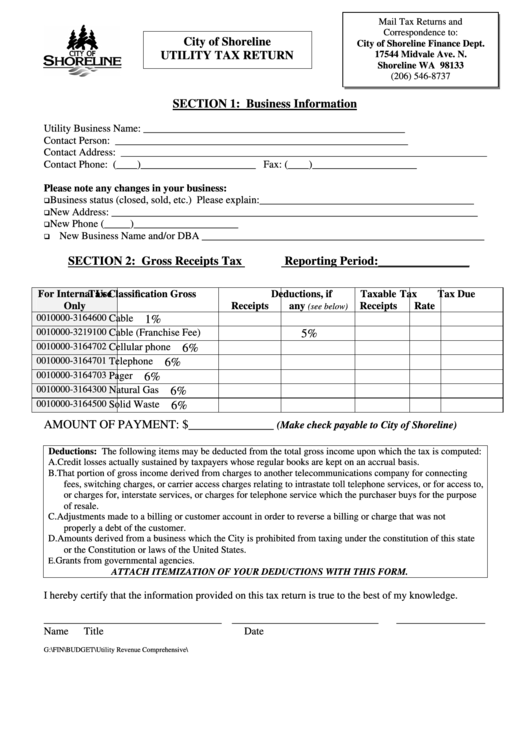

SECTION 1: Business Information

Utility Business Name: __________________________________________________

Contact Person: ________________________________________________________

Contact Address: ______________________________________________________________________

Contact Phone: (____)______________________ Fax: (____)____________________

Please note any changes in your business:

Business status (closed, sold, etc.) Please explain:_________________________________________

New Address: ______________________________________________________________________

New Phone (_____)____________________

New Business Name and/or DBA ______________________________________________________

SECTION 2: Gross Receipts Tax

Reporting Period:_______________

For Internal Use

Tax Classification

Gross

Deductions, if

Taxable

Tax

Tax Due

Only

Receipts

any

Receipts

Rate

(see below)

0010000-3164600

Cable

1%

0010000-3219100

Cable (Franchise Fee)

5%

0010000-3164702

Cellular phone

6%

0010000-3164701

Telephone

6%

0010000-3164703

Pager

6%

0010000-3164300

Natural Gas

6%

0010000-3164500

Solid Waste

6%

AMOUNT OF PAYMENT: $______________

(Make check payable to City of Shoreline)

Deductions: The following items may be deducted from the total gross income upon which the tax is computed:

A. Credit losses actually sustained by taxpayers whose regular books are kept on an accrual basis.

B. That portion of gross income derived from charges to another telecommunications company for connecting

fees, switching charges, or carrier access charges relating to intrastate toll telephone services, or for access to,

or charges for, interstate services, or charges for telephone service which the purchaser buys for the purpose

of resale.

C. Adjustments made to a billing or customer account in order to reverse a billing or charge that was not

properly a debt of the customer.

D. Amounts derived from a business which the City is prohibited from taxing under the constitution of this state

or the Constitution or laws of the United States.

Grants from governmental agencies.

E.

ATTACH ITEMIZATION OF YOUR DEDUCTIONS WITH THIS FORM.

I hereby certify that the information provided on this tax return is true to the best of my knowledge.

__________________________________ ____________________________

_________________

Name

Title

Date

G:\FIN\BUDGET\Utility Revenue Comprehensive\UtilityTaxReturn.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1