Return For Occupation Tax - Utilities Form - Washington

ADVERTISEMENT

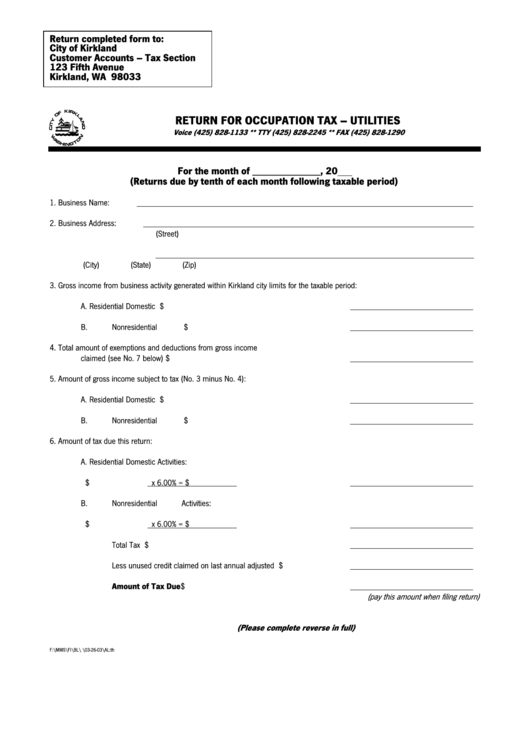

Return completed form to:

City of Kirkland

Customer Accounts – Tax Section

123 Fifth Avenue

Kirkland, WA 98033

RETURN FOR OCCUPATION TAX – UTILITIES

Voice (425) 828-1133 ** TTY (425) 828-2245 ** FAX (425) 828-1290

For the month of _____________, 20

(Returns due by tenth of each month following taxable period)

1.

Business Name:

2.

Business Address:

(Street)

(City)

(State)

(Zip)

3.

Gross income from business activity generated within Kirkland city limits for the taxable period:

A.

Residential Domestic Activities.................................................................. $

B.

Nonresidential Activities ........................................................................... $

4.

Total amount of exemptions and deductions from gross income

claimed (see No. 7 below)....................................................................................... $

5.

Amount of gross income subject to tax (No. 3 minus No. 4):

A.

Residential Domestic Activities.................................................................. $

B.

Nonresidential Activities ........................................................................... $

6.

Amount of tax due this return:

A.

Residential Domestic Activities:

$

x 6.00% =

$

B.

Nonresidential Activities:

$

x 6.00% =

$

Total Tax Due........................................................................................... $

Less unused credit claimed on last annual adjusted return ....................... $

Amount of Tax Due .............................................................................. $

(pay this amount when filing return)

(Please complete reverse in full)

F:\MMS\FI\BL\OC-TAX.DOC\03-26-03\AL:th

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4