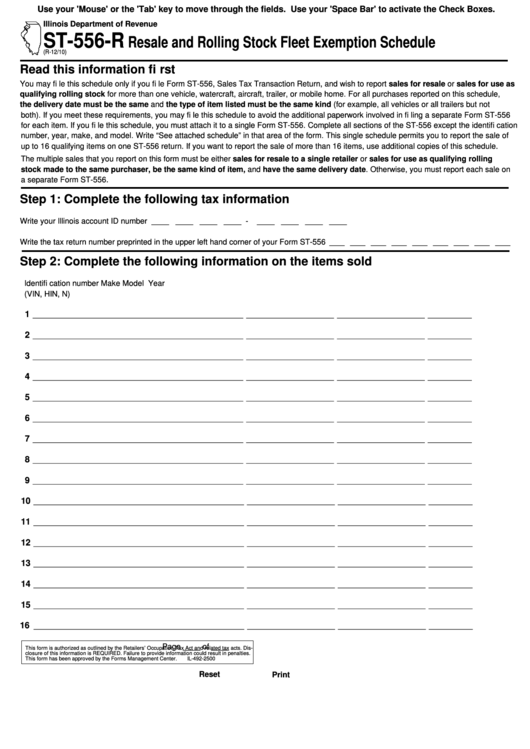

Use your 'Mouse' or the 'Tab' key to move through the fields. Use your 'Space Bar' to activate the Check Boxes.

Illinois Department of Revenue

ST-556-R

Resale and Rolling Stock Fleet Exemption Schedule

(R-12/10)

Read this information fi rst

You may fi le this schedule only if you fi le Form ST-556, Sales Tax Transaction Return, and wish to report sales for resale or sales for use as

qualifying rolling stock for more than one vehicle, watercraft, aircraft, trailer, or mobile home. For all purchases reported on this schedule,

the delivery date must be the same and the type of item listed must be the same kind (for example, all vehicles or all trailers but not

both). If you meet these requirements, you may fi le this schedule to avoid the additional paperwork involved in fi ling a separate Form ST-556

for each item. If you fi le this schedule, you must attach it to a single Form ST-556. Complete all sections of the ST-556 except the identifi cation

number, year, make, and model. Write “See attached schedule” in that area of the form. This single schedule permits you to report the sale of

up to 16 qualifying items on one ST-556 return. If you want to report the sale of more than 16 items, use additional copies of this schedule.

The multiple sales that you report on this form must be either sales for resale to a single retailer or sales for use as qualifying rolling

stock made to the same purchaser, be the same kind of item, and have the same delivery date. Otherwise, you must report each sale on

a separate Form ST-556.

Step 1: Complete the following tax information

Write your Illinois account ID number ____ ____ ____ ____ - ____ ____ ____ ____

Write the tax return number preprinted in the upper left hand corner of your Form ST-556 ____ ____ ____ ____ ____ ____ ____ ____ ____

Step 2: Complete the following information on the items sold

Identifi cation number

Make

Model

Year

(VIN, HIN, N)

1

________________________________________________

____________________

____________________

__________

2

________________________________________________

____________________

____________________

__________

3

________________________________________________

____________________

____________________

__________

4

________________________________________________

____________________

____________________

__________

5

________________________________________________

____________________

____________________

__________

6

________________________________________________

____________________

____________________

__________

7

________________________________________________

____________________

____________________

__________

8

________________________________________________

____________________

____________________

__________

9

________________________________________________

____________________

____________________

__________

10

________________________________________________

____________________

____________________

__________

11

________________________________________________

____________________

____________________

__________

12

________________________________________________

____________________

____________________

__________

13

________________________________________________

____________________

____________________

__________

14

________________________________________________

____________________

____________________

__________

15

________________________________________________

____________________

____________________

__________

16

________________________________________________

____________________

____________________

__________

Page ____ of ____

This form is authorized as outlined by the Retailers’ Occupation Tax Act and related tax acts. Dis-

closure of this information is REQUIRED. Failure to provide information could result in penalties.

This form has been approved by the Forms Management Center.

IL-492-2500

Reset

Print

1

1