Form Ct-941 (Drs) - Connecticut Quarterly Reconciliation Of Withholding - 2008

ADVERTISEMENT

Department of Revenue Services

2008

Form CT-941 (DRS)

PO Box 2931

Hartford, CT 06104-2931

Connecticut Quarterly Reconciliation of Withholding

(Rev. 07/08)

General Instructions

instead of filing Form CT-941 for each calendar quarter. See

Informational Publication 2008(1).

Complete the return in blue or black ink only.

Rounding Off to Whole Dollars: You must round off cents to the

Form CT-941 (DRS), Connecticut Quarterly Reconciliation of

nearest whole dollar on your returns and schedules. Round

Withholding, may be used by new employers who have not

down to the next lowest dollar all amounts that include 1 through

received the Employer’s Withholding Remittance Coupon Book

49 cents. Round up to the next highest dollar all amounts that

for calendar year 2008. Use Form CT-941 to reconcile your quarterly

include 50 through 99 cents. However, if you need to add two or

Connecticut income tax withholding payments from wages only.

more amounts to compute the amount to enter on a line, include

Payers of nonpayroll amounts must use Form CT-945, Connecticut

cents and round off only the total. If you do not round, DRS will

Annual Reconciliation of Withholding for Nonpayroll Amounts, to

disregard the cents.

reconcile Connecticut income tax withholding.

Example: Add two amounts ($1.29 + $3.21) to compute the total

All employers who are registered for Connecticut income tax

($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered

withholding purposes (other than household employers,

on the line.

agricultural employers granted annual filer status, and seasonal

filers) are required to file Form CT-941 for each calendar quarter

Reminders:

as long as they have an active withholding account with the

See instructions on back.

Department of Revenue Services (DRS) even if no tax is due or

Be sure to complete all requested information on the back

if no tax was required to be withheld for that quarter.

of this return.

Due Dates: First quarter, April 30, 2008; second quarter, July 31, 2008;

Sign and date the return in the space provided.

third quarter, October 31, 2008; and fourth quarter, January 31, 2009.

If payment is due, remit payment with this return.

An employer who made timely deposits of Connecticut

withholding tax in full payment of such taxes due for the quarter

Make your check payable to: Commissioner of Revenue

may file the return on or before the tenth day of the second

Services.

calendar month following the end of the quarter. If the due date

DRS may submit your check to your bank electronically.

falls on a Saturday, Sunday, or legal holiday, the next business

Write your Connecticut Tax Registration Number and calendar

day is the due date.

quarter to which the payment applies on check.

Household employers who are registered to withhold

Connecticut income tax from wages of their household

Where to File: Visit the Taxpayer Service Center (TSC) at the

DRS website to electronically file this return.

employees are not to file Form CT-941 for each calendar quarter,

Mail your completed return and payment (if applicable) to:

but instead are required to file one Form CT-941 for the entire

Department of Revenue Services, PO Box 2931, Hartford CT

calendar year, the due date of which is April 15, 2009. Payment of

06104-2931.

the Connecticut income tax withheld from wages of household

employees during the entire calendar year is to accompany Form

Amended Return: To amend Form CT-941, use Form

CT-941. See Informational Publication 2008(1), Connecticut

CT-941X, Amended Connecticut Reconciliation of Withholding.

Circular CT, Employer’s Tax Guide.

Forms and Publications: Forms and publications may be

Seasonal filers may request permission from DRS to file Form

obtained by visiting the DRS website at or by

CT-941 only for the calendar quarters in which they pay Connecticut

calling the DRS Forms Unit at 860-297-4753.

wages to employees. Certain agricultural employers may request

permission to file one Form CT-941 for the entire calendar year

Separate Here and Mail Coupon to DRS. Make a Copy for Your Records.

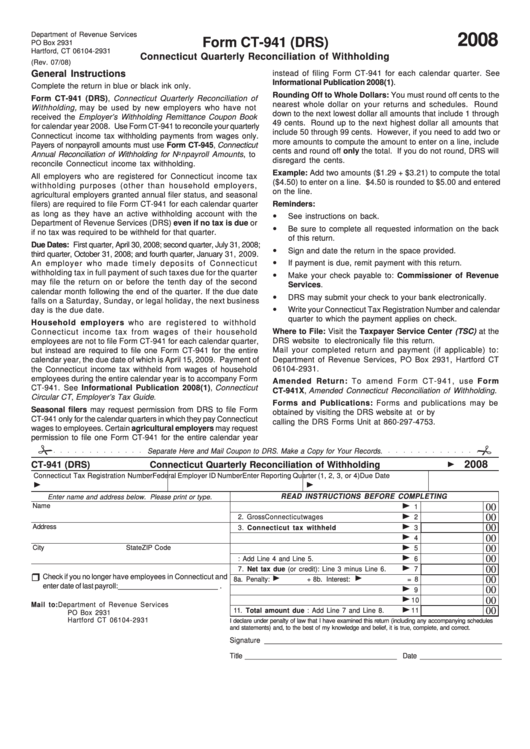

2008

CT-941 (DRS)

Connecticut Quarterly Reconciliation of Withholding

Connecticut Tax Registration Number

Federal Employer ID Number

Enter Reporting Quarter (1, 2, 3, or 4) Due Date

READ INSTRUCTIONS BEFORE COMPLETING

Enter name and address below. Please print or type.

Name

00

1. Gross wages

1

00

2. Gross Connecticut wages

2

Address

00

3. Connecticut tax withheld

3

00

4. Credit from prior quarter

4

City

State

ZIP Code

00

5. Payments made for this quarter

5

00

6. Total payments: Add Line 4 and Line 5.

6

00

7. Net tax due (or credit): Line 3 minus Line 6.

7

Check if you no longer have employees in Connecticut and

00

8a. Penalty:

+ 8b. Interest:

= 8

enter date of last payroll: ________________________ .

00

9. Amount to be credited

9

00

10. Amount to be refunded

10

Mail to:

Department of Revenue Services

00

11. Total amount due : Add Line 7 and Line 8.

11

PO Box 2931

Hartford CT 06104-2931

I declare under penalty of law that I have examined this return (including any accompanying schedules

and statements) and, to the best of my knowledge and belief, it is true, complete, and correct.

Signature _____________________________________________________________

Title _______________________________________ Date _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2