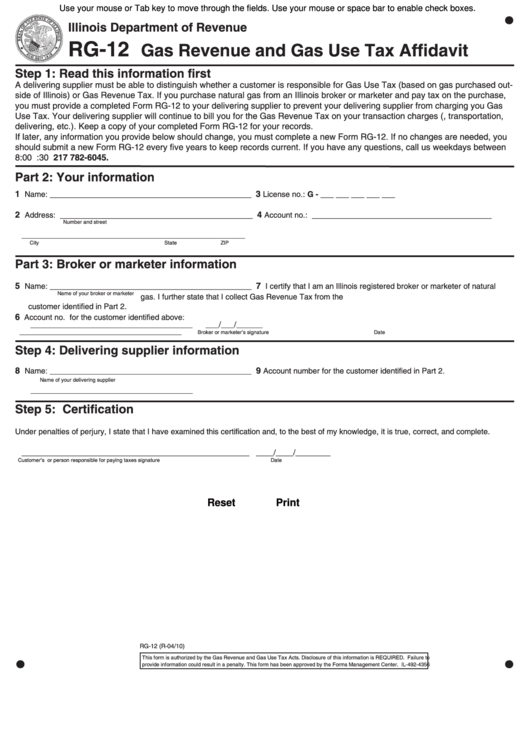

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RG-12

Gas Revenue and Gas Use Tax Affidavit

Step 1: Read this information first

A delivering supplier must be able to distinguish whether a customer is responsible for Gas Use Tax (based on gas purchased out-

side of Illinois) or Gas Revenue Tax. If you purchase natural gas from an Illinois broker or marketer and pay tax on the purchase,

you must provide a completed Form RG-12 to your delivering supplier to prevent your delivering supplier from charging you Gas

Use Tax. Your delivering supplier will continue to bill you for the Gas Revenue Tax on your transaction charges (e.g., transportation,

delivering, etc.). Keep a copy of your completed Form RG-12 for your records.

If later, any information you provide below should change, you must complete a new Form RG-12. If no changes are needed, you

should submit a new Form RG-12 every five years to keep records current. If you have any questions, call us weekdays between

8:00 a.m. and 4:30 p.m. at 217 782-6045.

Part 2: Your information

1

3

Name: ______________________________________________

License no.: G - ___ ___ ___ ___ ___

2

4

Address: ____________________________________________

Account no.: _________________________________________

Number and street

___________________________________________________

City

State

ZIP

Part 3: Broker or marketer information

5

7

Name: ______________________________________________

I certify that I am an Illinois registered broker or marketer of natural

Name of your broker or marketer

gas. I further state that I collect Gas Revenue Tax from the

customer identified in Part 2.

6

Account no. for the customer identified above:

_____________________________________

___/___/______

_____________________________________

Broker or marketer’s signature

Date

Step 4: Delivering supplier information

8

9

Name: ______________________________________________

Account number for the customer identified in Part 2.

Name of your delivering supplier

_____________________________________

Step 5: Certification

Under penalties of perjury, I state that I have examined this certification and, to the best of my knowledge, it is true, correct, and complete.

____________________________________________________

____/____/________

Customer’s or person responsible for paying taxes signature

Date

Reset

Print

RG-12 (R-04/10)

This form is authorized by the Gas Revenue and Gas Use Tax Acts. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-4356

1

1