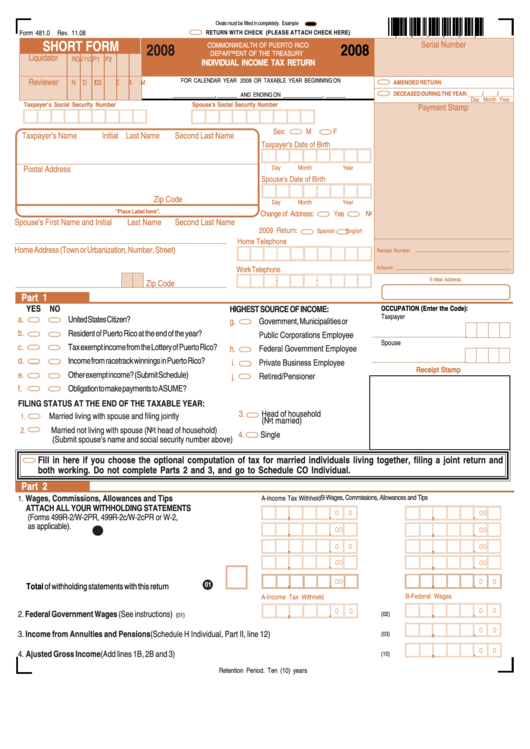

Form 481.0 - Individual Income Tax Return - 2008

ADVERTISEMENT

Ovals must be filled in completely. Example

Form 481.0

Rev. 11.08

RETURN WITH CHECK (PLEASE ATTACH CHECK HERE)

E

S

0

8

0

0

SHORT FORM

Serial Number

2008

COMMONWEALTH OF PUERTO RICO

2008

DEPARTMENT OF THE TREASURY

Liquidator

R

G V1 V2 P1 P2

INDIVIDUAL INCOME TAX RETURN

FOR CALENDAR YEAR 2008 OR TAXABLE YEAR BEGINNING ON

Reviewer

N D1

D2

E

A

M

AMENDED RETURN

DECEASED DURING THE YEAR: _____/_____/_____

_______________, _______ AND ENDING ON ______________, _______

Day Month Year

Taxpayer’s Social Security Number

Spouse's Social Security Number

Payment Stamp

Sex:

M

F

Taxpayer’s Name

Initial

Last Name

Second Last Name

Taxpayer's Date of Birth

Postal Address

Day

Month

Year

Spouse's Date of Birth

Zip Code

Day

Month

Year

"Place Label here".

Change of Address:

Yes

No

Spouse's First Name and Initial

Last Name

Second Last Name

2009 Return:

Spanish

English

Home Telephone

Home Address (Town or Urbanization, Number, Street)

Receipt Number:

Amount:

Work Telephone

E-Mail Address

Zip Code

Part 1

YES

NO

HIGHEST SOURCE OF INCOME:

OCCUPATION (Enter the Code):

Taxpayer

a.

United States Citizen?

Government, Municipalities or

g.

b.

Resident of Puerto Rico at the end of the year?

Public Corporations Employee

Spouse

c.

Tax exempt income from the Lottery of Puerto Rico?

Federal Government Employee

h.

d.

Income from racetrack winnings in Puerto Rico?

Private Business Employee

i.

Receipt Stamp

e.

Other exempt income? (Submit Schedule)

j.

Retired/Pensioner

f.

Obligation to make payments to ASUME?

FILING STATUS AT THE END OF THE TAXABLE YEAR:

3.

Head of household

Married living with spouse and filing jointly

1.

(Not married)

Married not living with spouse (Not head of household)

2.

4.

Single

(Submit spouse's name and social security number above)

Fill in here if you choose the optional computation of tax for married individuals living together, filing a joint return and

both working. Do not complete Parts 2 and 3, and go to Schedule CO Individual.

Part 2

B-Wages, Commissions, Allowances and Tips

Wages, Commissions, Allowances and Tips

1.

A-Income Tax Withheld

ATTACH ALL YOUR WITHHOLDING STATEMENTS

.

.

0

0

0

0

,

,

(Forms 499R-2/W-2PR, 499R-2c/W-2cPR or W-2,

as applicable).

00

.

0

0

.

0

0

,

,

.

0

0

.

0

0

,

,

.

0

0

.

0

0

,

,

.

.

0

0

0

0

,

,

01

Total of withholding statements with this return ...........................

B-Federal Wages

A-Income Tax Withheld

.

0

0

.

2. Federal Government Wages (See instructions) .............................

0

0

,

,

(02)

(01)

.

0

0

,

3. Income from Annuities and Pensions (Schedule H Individual, Part II, line 12) ................................................

(03)

.

0

0

4. Ajusted Gross Income (Add lines 1B, 2B and 3) ...............................................................................................

,

(10)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3