Non-Resident Employee Refund Application Form For Days Worked Out Of Gahanna - Ohio - Division Of Taxation

ADVERTISEMENT

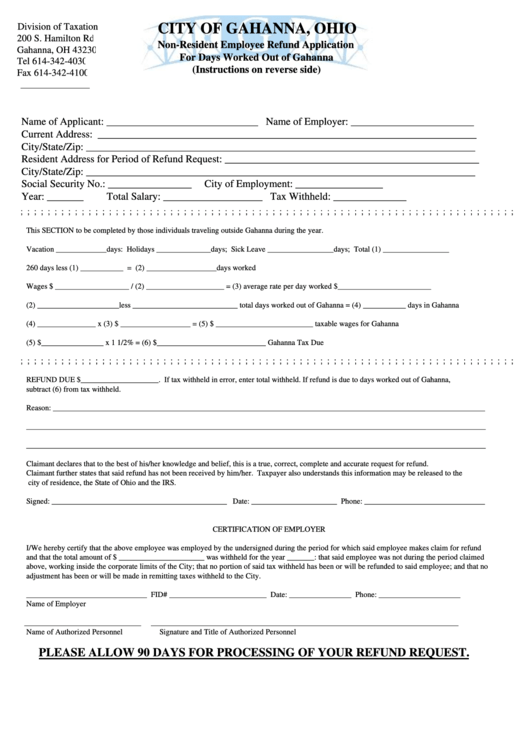

Division of Taxation

CITY OF GAHANNA, OHIO

200 S. Hamilton Rd

Non-Resident Employee Refund Application

Gahanna, OH 43230

For Days Worked Out of Gahanna

Tel 614-342-4030

(Instructions on reverse side)

Fax 614-342-4100

Name of Applicant: _____________________________ Name of Employer: ________________________

Current Address: _________________________________________________________________________

City/State/Zip: ___________________________________________________________________________

Resident Address for Period of Refund Request: _________________________________________________

City/State/Zip: ___________________________________________________________________________

Social Security No.: ________________

City of Employment: _________________

Year: _______

Total Salary: ___________________ Tax Withheld: _______________

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

This SECTION to be completed by those individuals traveling outside Gahanna during the year.

Vacation _____________days: Holidays ______________days; Sick Leave _________________days; Total (1) _________________

260 days less (1) ___________ = (2) __________________days worked

Wages $ ___________________ / (2) ____________________ = (3) average rate per day worked $________________________

(2) _____________________less ___________________________ total days worked out of Gahanna = (4) ___________ days in Gahanna

(4) _______________ x (3) $ __________________ = (5) $ _________________________ taxable wages for Gahanna

(5) $________________ x 1 1/2% = (6) $____________________________ Gahanna Tax Due

;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;;

REFUND DUE $____________________. If tax withheld in error, enter total withheld. If refund is due to days worked out of Gahanna,

subtract (6) from tax withheld.

Reason: _______________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________

Claimant declares that to the best of his/her knowledge and belief, this is a true, correct, complete and accurate request for refund.

Claimant further states that said refund has not been received by him/her. Taxpayer also understands this information may be released to the

city of residence, the State of Ohio and the IRS.

Signed: _____________________________________________ Date: ______________________ Phone: _______________________________

CERTIFICATION OF EMPLOYER

I/We hereby certify that the above employee was employed by the undersigned during the period for which said employee makes claim for refund

and that the total amount of $ ______________________ was withheld for the year _______: that said employee was not during the period claimed

above, working inside the corporate limits of the City; that no portion of said tax withheld has been or will be refunded to said employee; and that no

adjustment has been or will be made in remitting taxes withheld to the City.

_______________________________ FID# _________________________ Date: ________________ Phone: _____________________

Name of Employer

______________________________

_______________________________________________________________________________

Name of Authorized Personnel

Signature and Title of Authorized Personnel

PLEASE ALLOW 90 DAYS FOR PROCESSING OF YOUR REFUND REQUEST.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2