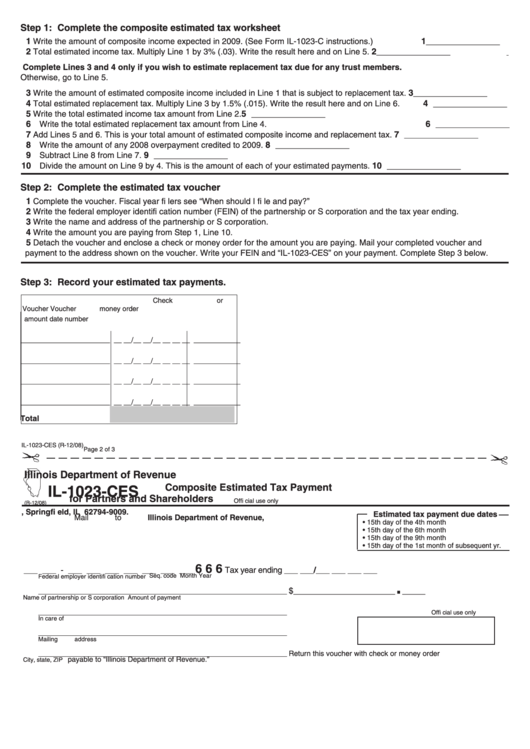

Step 1: Complete the composite estimated tax worksheet

1

Write the amount of composite income expected in 2009. (See Form IL-1023-C instructions.)

1

________________

2

Total estimated income tax. Multiply Line 1 by 3% (.03). Write the result here and on Line 5.

2

________________

Complete Lines 3 and 4 only if you wish to estimate replacement tax due for any trust members.

Otherwise, go to Line 5.

3

3

Write the amount of estimated composite income included in Line 1 that is subject to replacement tax.

________________

4

Total estimated replacement tax. Multiply Line 3 by 1.5% (.015). Write the result here and on Line 6.

4

________________

5

Write the total estimated income tax amount from Line 2.

5

________________

6

6

Write the total estimated replacement tax amount from Line 4.

________________

7

7

Add Lines 5 and 6. This is your total amount of estimated composite income and replacement tax.

________________

8

8

Write the amount of any 2008 overpayment credited to 2009.

________________

9

Subtract Line 8 from Line 7.

9

________________

10

Divide the amount on Line 9 by 4. This is the amount of each of your estimated payments.

10

________________

Step 2: Complete the estimated tax voucher

1

Complete the voucher. Fiscal year fi lers see “When should I fi le and pay?”

2

Write the federal employer identifi cation number (FEIN) of the partnership or S corporation and the tax year ending.

3

Write the name and address of the partnership or S corporation.

4

Write the amount you are paying from Step 1, Line 10.

5

Detach the voucher and enclose a check or money order for the amount you are paying. Mail your completed voucher and

payment to the address shown on the voucher. Write your FEIN and “IL-1023-CES” on your payment. Complete Step 3 below.

Step 3: Record your estimated tax payments.

Check or

Voucher

Voucher

money order

amount

date

number

_______________________ __ __/__ __/__ __ __ __ ____________

_______________________ __ __/__ __/__ __ __ __ ____________

_______________________ __ __/__ __/__ __ __ __ ____________

_______________________ __ __/__ __/__ __ __ __ ____________

Total

IL-1023-CES (R-12/08)

Page 2 of 3

Illinois Department of Revenue

Composite Estimated Tax Payment

IL-1023-CES

for Partners and Shareholders

Offi cial use only

(R-12/08)

Estimated tax payment due dates

Mail to Illinois Department of Revenue,

• 15th day of the 4th month

P.O. Box 19009, Springfi eld, IL 62794-9009.

• 15th day of the 6th month

• 15th day of the 9th month

• 15th day of the 1st month of subsequent yr.

6 6 6

___ ___ - ___ ___ ___ ___ ___ ___ ___

Tax year ending ___ ___/___ ___ ___ ___

Seq. code

Month

Year

.

Federal employer identifi cation number

$______________________

_____

_________________________________________________________________________

Name of partnership or S corporation

Amount of payment

_________________________________________________________________________

Offi cial use only

In care of

_________________________________________________________________________

Mailing address

Return this voucher with check or money order

_________________________________________________________________________

payable to “Illinois Department of Revenue.”

City, state, ZIP

1

1 2

2