Form Rv-F1404701 - Franchise And Excise Tax Intangible Expense Disclosure Form - Tennessee Department Of Revenue

ADVERTISEMENT

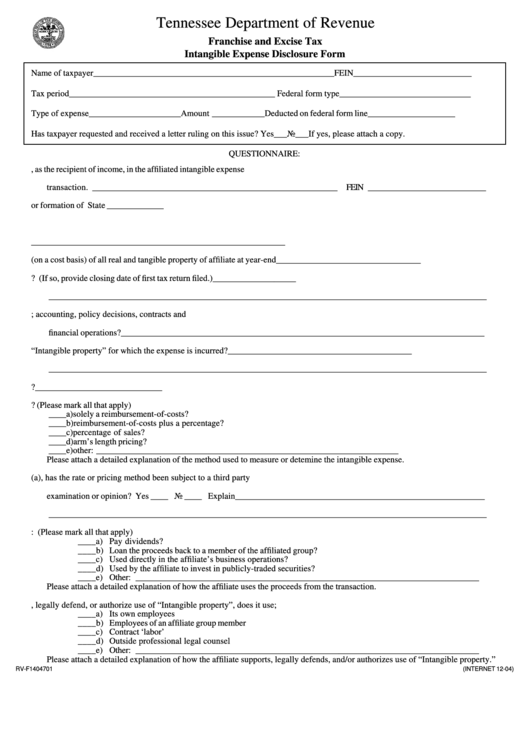

Tennessee Department of Revenue

Franchise and Excise Tax

Intangible Expense Disclosure Form

Name of taxpayer _______________________________________________________ FEIN ___________________________

Tax period _______________________________________________

Federal form type ______________________________

Type of expense _____________________

Amount ____________

Deducted on federal form line ____________________

Has taxpayer requested and received a letter ruling on this issue? Yes ___

No ___

If yes, please attach a copy.

QUESTIONNAIRE:

1.

Name and FEIN of affiliate, as the recipient of income, in the affiliated intangible expense

transaction. ________________________________________________________ FEIN ___________________________

2.

Date and state of incorporation or formation of affiliate.

Date __________________

State _____________

3.

Business activity of affiliate. _____________________________________________________________________________

4.

Number of full-time employees of affiliate at year-end __________________________________________________________

5.

Dollar-value (on a cost basis) of all real and tangible property of affiliate at year-end _________________________________

6.

Does affiliate file franchise and excise tax returns? (If so, provide closing date of first tax return filed.) ___________________

____________________________________________________________________________________________________

7.

Location of where principle business activities of the affiliate take place such as; accounting, policy decisions, contracts and

financial operations? ___________________________________________________________________________________

8.

List the type of “Intangible property” for which the expense is incurred? __________________________________________

____________________________________________________________________________________________________

9.

Does the expense occur on an annual or regular basis or is it a one-time or special event? _____________________________

10. By what method is the intangible expense measured or determined? (Please mark all that apply)

____ a) solely a reimbursement-of-costs?

____ b) reimbursement-of-costs plus a percentage?

____ c) percentage of sales?

____ d) arm’s length pricing?

____ e) other: _____________________________________________________________________

Please attach a detailed explanation of the method used to measure or detemine the intangible expense.

11. If the answer to the prior question is anything other than (a), has the rate or pricing method been subject to a third party

examination or opinion? Yes ____ No ____ Explain _________________________________________________________

____________________________________________________________________________________________________

12. Does the affiliate use the proceeds from the expense transaction to: (Please mark all that apply)

____a) Pay dividends?

____b) Loan the proceeds back to a member of the affiliated group?

____c) Used directly in the affiliate’s business operations?

____d) Used by the affiliate to invest in publicly-traded securities?

____e) Other: ________________________________________________________________________________

Please attach a detailed explanation of how the affiliate uses the proceeds from the transaction.

13. When the affiliate has to support, legally defend, or authorize use of “Intangible property”, does it use;

____a) Its own employees

____b) Employees of an affiliate group member

____c) Contract ‘labor’

____d) Outside professional legal counsel

____e) Other: ________________________________________________________________________________

Please attach a detailed explanation of how the affiliate supports, legally defends, and/or authorizes use of “Intangible property.”

RV-F1404701

(INTERNET 12-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2