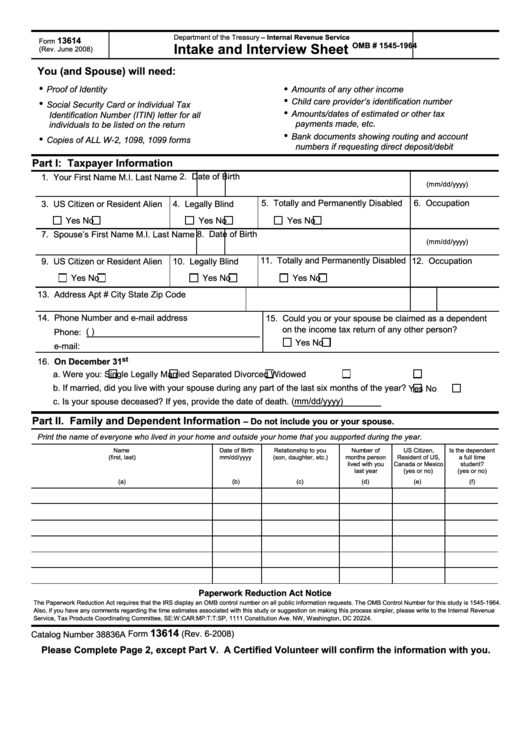

Department of the Treasury – Internal Revenue Service

13614

Form

Intake and Interview Sheet

OMB # 1545-1964

(Rev. June 2008)

You (and Spouse) will need:

•

•

Proof of Identity

Amounts of any other income

•

•

Child care provider’s identification number

Social Security Card or Individual Tax

•

Amounts/dates of estimated or other tax

Identification Number (ITIN) letter for all

payments made, etc.

individuals to be listed on the return

•

Bank documents showing routing and account

•

Copies of ALL W-2, 1098, 1099 forms

numbers if requesting direct deposit/debit

Part I: Taxpayer Information

2. Date of Birth

1. Your First Name

M.I.

Last Name

(mm/dd/yyyy)

5. Totally and Permanently Disabled

6. Occupation

3. US Citizen or Resident Alien

4. Legally Blind

Yes

No

Yes

No

Yes

No

8. Date of Birth

7. Spouse’s First Name

M.I.

Last Name

(mm/dd/yyyy)

11. Totally and Permanently Disabled

12. Occupation

9. US Citizen or Resident Alien

10. Legally Blind

Yes

No

Yes

No

Yes

No

13. Address

Apt # City

State Zip Code

14. Phone Number and e-mail address

15. Could you or your spouse be claimed as a dependent

on the income tax return of any other person?

Phone: (

)

Yes

No

e-mail:

st

16. On December 31

a. Were you:

Single

Legally Married

Separated

Divorced

Widowed

b. If married, did you live with your spouse during any part of the last six months of the year?

Yes

No

c. Is your spouse deceased? If yes, provide the date of death.

(mm/dd/yyyy)

Part II. Family and Dependent Information

– Do not include you or your spouse.

Print the name of everyone who lived in your home and outside your home that you supported during the year.

Name

Date of Birth

Relationship to you

Number of

US Citizen,

Is the dependent

(first, last)

mm/dd/yyyy

(son, daughter, etc.)

months person

Resident of US,

a full time

lived with you

Canada or Mexico

student?

last year

(yes or no)

(yes or no)

(a)

(b)

(c)

(d)

(e)

(f)

Paperwork Reduction Act Notice

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1964.

Also, if you have any comments regarding the time estimates associated with this study or suggestion on making this process simpler, please write to the Internal Revenue

Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

13614

Form

(Rev. 6-2008)

Catalog Number 38836A

Please Complete Page 2, except Part V. A Certified Volunteer will confirm the information with you.

1

1 2

2