Tdd I Sales Tax Collection Form - The Wentzville Transportation Development District

ADVERTISEMENT

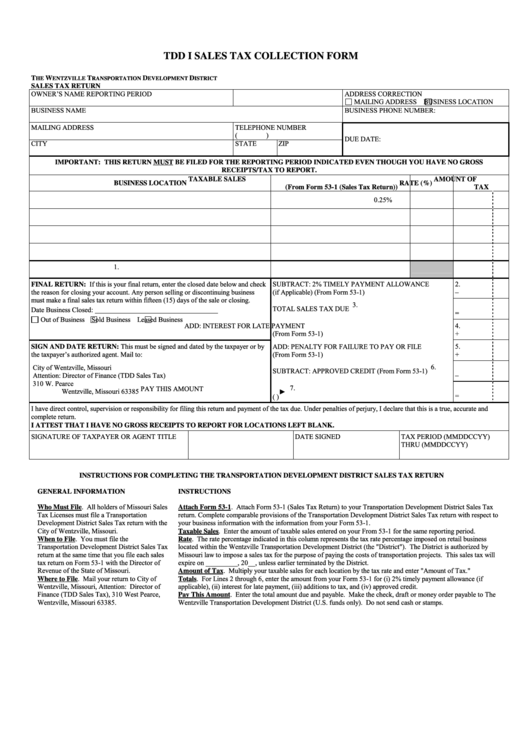

TDD I SALES TAX COLLECTION FORM

T

W

T

D

D

HE

ENTZVILLE

RANSPORTATION

EVELOPMENT

ISTRICT

SALES TAX RETURN

OWNER’S NAME

REPORTING PERIOD

ADDRESS CORRECTION

MAILING ADDRESS

BUSINESS LOCATION

BUSINESS NAME

BUSINESS PHONE NUMBER:

MAILING ADDRESS

TELEPHONE NUMBER

(

)

DUE DATE:

CITY

STATE

ZIP

IMPORTANT: THIS RETURN MUST BE FILED FOR THE REPORTING PERIOD INDICATED EVEN THOUGH YOU HAVE NO GROSS

RECEIPTS/TAX TO REPORT.

TAXABLE SALES

AMOUNT OF

BUSINESS LOCATION

RATE (%)

(From Form 53-1 (Sales Tax Return))

TAX

0.25%

1.

TOTAL ........................................................................................................................

FINAL RETURN: If this is your final return, enter the closed date below and check

SUBTRACT: 2% TIMELY PAYMENT ALLOWANCE

2.

the reason for closing your account. Any person selling or discontinuing business

(if Applicable) (From Form 53-1) ................................................

–

must make a final sales tax return within fifteen (15) days of the sale or closing.

3.

TOTAL SALES TAX DUE .........................................................

Date Business Closed:

=

Out of Business

Sold Business

Leased Business

ADD: INTEREST FOR LATE PAYMENT

4.

(From Form 53-1) .........................................................................

+

SIGN AND DATE RETURN: This must be signed and dated by the taxpayer or by

ADD: PENALTY FOR FAILURE TO PAY OR FILE

5.

the taxpayer’s authorized agent. Mail to:

+

(From Form 53-1) .........................................................................

6.

City of Wentzville, Missouri

SUBTRACT: APPROVED CREDIT (From Form 53-1) ............

–

Attention: Director of Finance (TDD Sales Tax)

310 W. Pearce

7.

PAY THIS AMOUNT ............................................................

Wentzville, Missouri 63385

►

=

(U.S. Funds Only)

I have direct control, supervision or responsibility for filing this return and payment of the tax due. Under penalties of perjury, I declare that this is a true, accurate and

complete return.

I ATTEST THAT I HAVE NO GROSS RECEIPTS TO REPORT FOR LOCATIONS LEFT BLANK.

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE SIGNED

TAX PERIOD (MMDDCCYY)

THRU (MMDDCCYY)

INSTRUCTIONS FOR COMPLETING THE TRANSPORTATION DEVELOPMENT DISTRICT SALES TAX RETURN

GENERAL INFORMATION

INSTRUCTIONS

Who Must File. All holders of Missouri Sales

Attach Form 53-1. Attach Form 53-1 (Sales Tax Return) to your Transportation Development District Sales Tax

Tax Licenses must file a Transportation

return. Complete comparable provisions of the Transportation Development District Sales Tax return with respect to

Development District Sales Tax return with the

your business information with the information from your Form 53-1.

City of Wentzville, Missouri.

Taxable Sales. Enter the amount of taxable sales entered on your From 53-1 for the same reporting period.

When to File. You must file the

Rate. The rate percentage indicated in this column represents the tax rate percentage imposed on retail business

Transportation Development District Sales Tax

located within the Wentzville Transportation Development District (the "District"). The District is authorized by

return at the same time that you file each sales

Missouri law to impose a sales tax for the purpose of paying the costs of transportation projects. This sales tax will

tax return on Form 53-1 with the Director of

expire on _________, 20__, unless earlier terminated by the District.

Revenue of the State of Missouri.

Amount of Tax. Multiply your taxable sales for each location by the tax rate and enter "Amount of Tax."

Where to File. Mail your return to City of

Totals. For Lines 2 through 6, enter the amount from your Form 53-1 for (i) 2% timely payment allowance (if

Wentzville, Missouri, Attention: Director of

applicable), (ii) interest for late payment, (iii) additions to tax, and (iv) approved credit.

Finance (TDD Sales Tax), 310 West Pearce,

Pay This Amount. Enter the total amount due and payable. Make the check, draft or money order payable to The

Wentzville, Missouri 63385.

Wentzville Transportation Development District (U.S. funds only). Do not send cash or stamps.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1