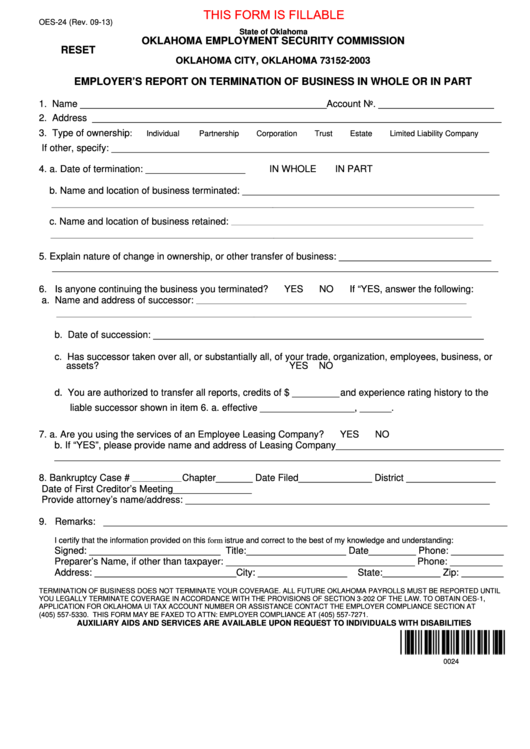

THIS FORM IS FILLABLE

OES-24 (Rev. 09-13)

State of Oklahoma

OKLAHOMA EMPLOYMENT SECURITY COMMISSION

RESET

P.O. Box 52003

OKLAHOMA CITY, OKLAHOMA 73152-2003

EMPLOYER’S REPORT ON TERMINATION OF BUSINESS IN WHOLE OR IN PART

1. Name _______________________________________________Account No. ______________________

2. Address ______________________________________________________________________________

3. Type of ownership

:

Individual

Partnership

Corporation

Trust

Estate

Limited Liability Company

If other, specify: ________________________________________________________________________

4. a. Date of termination: ___________________

IN WHOLE

IN PART

b. Name and location of business terminated: _________________________________________________

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

c. Name and location of business retained:

___________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

5. Explain nature of change in ownership, or other transfer of business: _____________________________

_____________________________________________________________________________________

6. Is anyone continuing the business you terminated?

YES

NO

If “YES, answer the following:

a. Name and address of successor:

_____________________________________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________________________________________________________________________________________________

b. Date of succession: _______________________________________________________________

c. Has successor taken over all, or substantially all, of your trade, organization, employees, business, or

assets?

YES

NO

d. You are authorized to transfer all reports, credits of $ _________ and experience rating history to the

liable successor shown in item 6. a. effective __________________, ______.

7. a. Are you using the services of an Employee Leasing Company?

YES

NO

b. If “YES”, please provide name and address of Leasing Company________________________________

_____________________________________________________________________________________

8. Bankruptcy Case #

Chapter_______ Date Filed______________ District _________________

___________________________

Date of First Creditor’s Meeting_______________

Provide attorney’s name/address: __________________________________________________________

9. Remarks: _____________________________________________________________________________

I certify that the information provided on this form is true and correct to the best of my knowledge and understanding:

Signed: _________________________ Title:___________________ Date_________ Phone: __________

Preparer’s Name, if other than taxpayer: ____________________________________ Phone: __________

Address: ___________________________City: _________________

State:___________ Zip: ________

TERMINATION OF BUSINESS DOES NOT TERMINATE YOUR COVERAGE. ALL FUTURE OKLAHOMA PAYROLLS MUST BE REPORTED UNTIL

YOU LEGALLY TERMINATE COVERAGE IN ACCORDANCE WITH THE PROVISIONS OF SECTION 3-202 OF THE LAW. TO OBTAIN OES-1,

APPLICATION FOR OKLAHOMA UI TAX ACCOUNT NUMBER OR ASSISTANCE CONTACT THE EMPLOYER COMPLIANCE SECTION AT

(405) 557-5330. THIS FORM MAY BE FAXED TO ATTN: EMPLOYER COMPLIANCE AT (405) 557-7271.

AUXILIARY AIDS AND SERVICES ARE AVAILABLE UPON REQUEST TO INDIVIDUALS WITH DISABILITIES

0024

1

1