Form Tc-65 - Partnership Return

ADVERTISEMENT

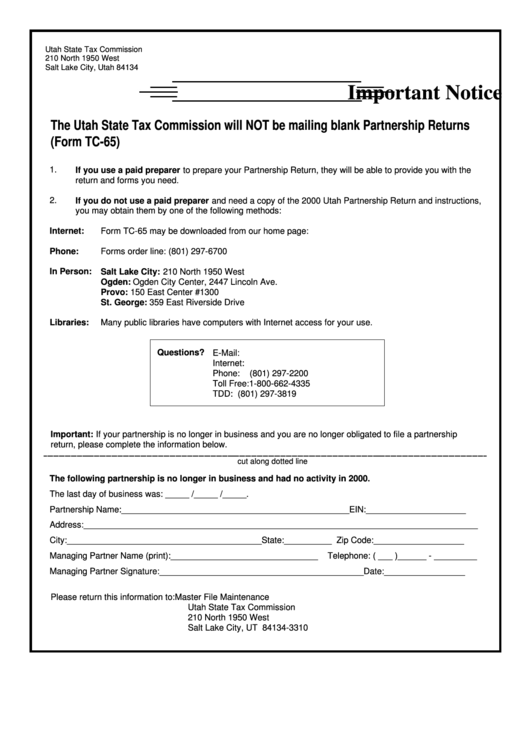

Utah State Tax Commission

210 North 1950 West

Salt Lake City, Utah 84134

Important Notice

The Utah State Tax Commission will NOT be mailing blank Partnership Returns

(Form TC-65)

1.

If you use a paid preparer

to prepare your Partnership Return, they will be able to provide you with the

return and forms you need.

2.

If you do not use a paid preparer

and need a copy of the 2000 Utah Partnership Return and instructions,

you may obtain them by one of the following methods:

Internet:

Form TC-65 may be downloaded from our home page:

Phone:

Forms order line: (801) 297-6700

In Person:

Salt Lake City:

210 North 1950 West

Ogden:

Ogden City Center, 2447 Lincoln Ave.

Provo:

150 East Center #1300

St. George:

359 East Riverside Drive

Libraries:

Many public libraries have computers with Internet access for your use.

Questions?

E-Mail:

Taxmaster@tax.ex.state.ut.us

Internet:

Phone:

(801) 297-2200

Toll Free:

1-800-662-4335

TDD:

(801) 297-3819

Important:

If your partnership is no longer in business and you are no longer obligated to file a partnership

return, please complete the information below.

cut along dotted line

The following partnership is no longer in business and had no activity in 2000.

The last day of business was: _____ /_____ /_____.

Partnership Name:________________________________________________

EIN:_____________________

Address:___________________________________________________________________________________

City:_________________________________________

State:__________ Zip Code:___________________

Managing Partner Name (print):_______________________________

Telephone: ( ___ )______ - _________

Managing Partner Signature:___________________________________________

Date:_________________

Please return this information to:

Master File Maintenance

Utah State Tax Commission

210 North 1950 West

Salt Lake City, UT 84134-3310

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1