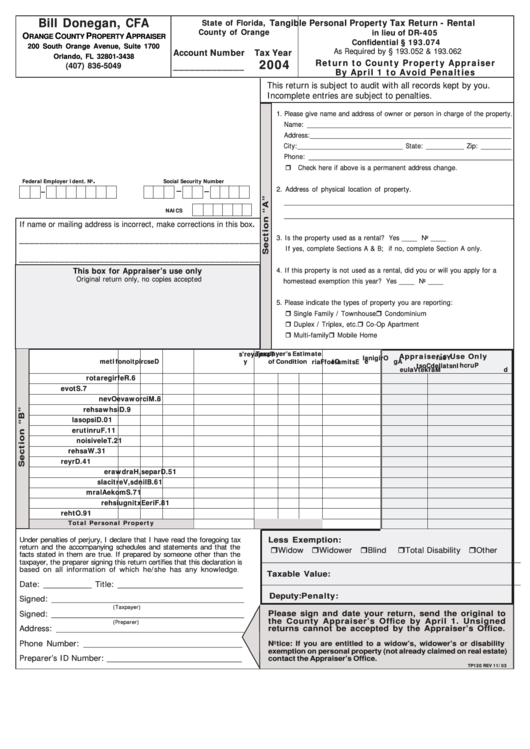

Tangible Personal Property Tax Return Form - Rental Form

ADVERTISEMENT

Bill Donegan, CFA

Tangible Personal Property Tax Return - Rental

State of Florida,

County of Orange

in lieu of DR-405

O

C

P

A

RANGE

OUNTY

ROPERTY

PPRAISER

Confidential § 193.074 F.S.

200 South Orange Avenue, Suite 1700

As Required by § 193.052 & 193.062 F.S.

Account Number Tax Year

Orlando, FL 32801-3438

2004

Return to County Property Appraiser

_____________

(407) 836-5049

By April 1 to Avoid Penalties

This return is subject to audit with all records kept by you.

Incomplete entries are subject to penalties.

1. Please give name and address of owner or person in charge of the property.

Name: ______________________________________________________

Address:_____________________________________________________

City:____________________________ State: __________ Zip: ________

Phone: ______________________________________________________

Check here if above is a permanent address change.

!

.

Federal Employer Ident. No

Social Security Number

2. Address of physical location of property.

_____________________________________________________________

NAICS

_____________________________________________________________

If name or mailing address is incorrect, make corrections in this box.

3. Is the property used as a rental? Yes ____ No ____

________________________________________________

If yes, complete Sections A & B; if no, complete Section A only.

________________________________________________

This box for Appraiser’s use only

4. If this property is not used as a rental, did you or will you apply for a

Original return only, no copies accepted

homestead exemption this year? Yes ____ No ____

5. Please indicate the types of property you are reporting:

! Single Family / Townhouse

! Condominium

! Duplex / Triplex, etc.

! Co-Op Apartment

! Multi-family

! Mobile Home

T

a

x

p

a

y

e

r

s '

Taxpayer’s Estimate

Appraiser’s Use Only

Y

e

a

r

O

r

g i

n i

l a

D

e

s

r c

p i

t

o i

n

f o

I

e t

m

Q

y t

A

g

e

E

s

i t

m

a

e t

f o

F

a

r i

of Condition

P

u

c r

h

I

n

t s

l a

e l

d

C

o

t s

M

a

r

k

e

t

V

a

u l

e

G

o

o

d

A

v

g

P

o

o

r

C

o

n

d

t i

o i

n

. 6

R

e

r f

g i

e

a r

t

o

r

. 7

S

t

o

v

e

. 8

M

i

r c

o

w

a

v

e

O

v

e

n

. 9

D

s i

h

w

a

s

h

e

r

1

. 0

D

s i

p

o

s

l a

1

. 1

F

u

r

n

t i

u

e r

1

. 2

T

e

e l

v

s i

o i

n

1

. 3

W

a

s

h

e

r

1

. 4

D

y r

e

r

1

. 5

D

a r

p

e

, s

H

a

r

d

w

a

e r

1

. 6

l B

n i

d

, s

V

e

t r

c i

a

s l

1

. 7

S

m

o

k

e

A

a l

r

m

1

. 8

i F

e r

E

x

t

n i

g

u

s i

h

e

r

1

. 9

O

t

h

e

r

Total Personal Property

Under penalties of perjury, I declare that I have read the foregoing tax

Less Exemption:

return and the accompanying schedules and statements and that the

!Total Disability !Other

!Widow !Widower !Blind

facts stated in them are true. If prepared by someone other than the

______________________________________________________

taxpayer, the preparer signing this return certifies that this declaration is

based on all information of which he/she has any knowledge

.

Taxable Value:

_______________________________________________________

Date: __________ Title: __________________________

Deputy:

Penalty:

Signed: ________________________________________

(Taxpayer)

Signed: ________________________________________

Please sign and date your return, send the original to

the County Appraiser ’s Office by April 1. Unsigned

(Preparer)

Address: _______________________________________

returns cannot be accepted by the Appraiser’s Office.

Phone Number: _________________________________

Notice: If you are entitled to a widow’s, widower’s or disability

exemption on personal property (not already claimed on real estate)

Preparer’s ID Number: ____________________________

contact the Appraiser’s Office.

TP120 REV 11/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1