Form 1040 - Extension Request 2015

ADVERTISEMENT

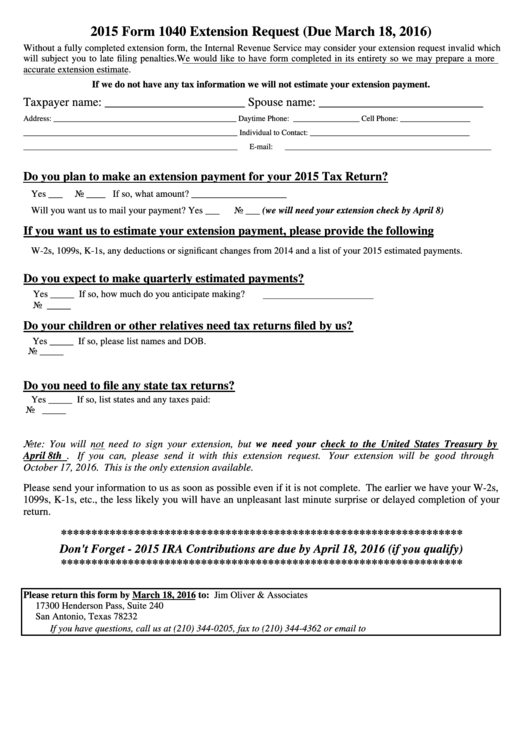

2015 Form 1040 Extension Request (Due March 18, 2016)

Without a fully completed extension form, the Internal Revenue Service may consider your extension request invalid which

will subject you to late filing penalties. We would like to have form completed in its entirety so we may prepare a more

accurate extension estimate.

If we do not have any tax information we will not estimate your extension payment.

Taxpayer name: _______________________ Spouse name: ___________________________

Address: _______________________________________________

Daytime Phone: _________________ Cell Phone: __________________

_______________________________________________________

Individual to Contact: _________________________________________

_______________________________________________________

E-mail: _____________________________________________________

Do you plan to make an extension payment for your 2015 Tax Return?

Yes ___

No ____ If so, what amount? ____________________

Will you want us to mail your payment? Yes ___

No ___

(we will need your extension check by April 8)

If you want us to estimate your extension payment, please provide the following

W-2s, 1099s, K-1s, any deductions or significant changes from 2014 and a list of your 2015 estimated payments.

Do you expect to make quarterly estimated payments?

Yes _____

If so, how much do you anticipate making?

No _____

Do your children or other relatives need tax returns filed by us?

Yes _____

If so, please list names and DOB.

No _____

Do you need to file any state tax returns?

Yes _____

If so, list states and any taxes paid:

No _____

Note: You will not need to sign your extension, but we need your check to the United States Treasury by

April 8th . If you can, please send it with this extension request. Your extension will be good through

October 17, 2016. This is the only extension available.

Please send your information to us as soon as possible even if it is not complete. The earlier we have your W-2s,

1099s, K-1s, etc., the less likely you will have an unpleasant last minute surprise or delayed completion of your

return.

******************************************************************

Don't Forget - 2015 IRA Contributions are due by April 18, 2016 (if you qualify)

******************************************************************

Please return this form by March 18, 2016 to:

Jim Oliver & Associates P.C.

17300 Henderson Pass, Suite 240

San Antonio, Texas 78232

If you have questions, call us at (210) 344-0205, fax to (210) 344-4362 or email to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1