Clear Form

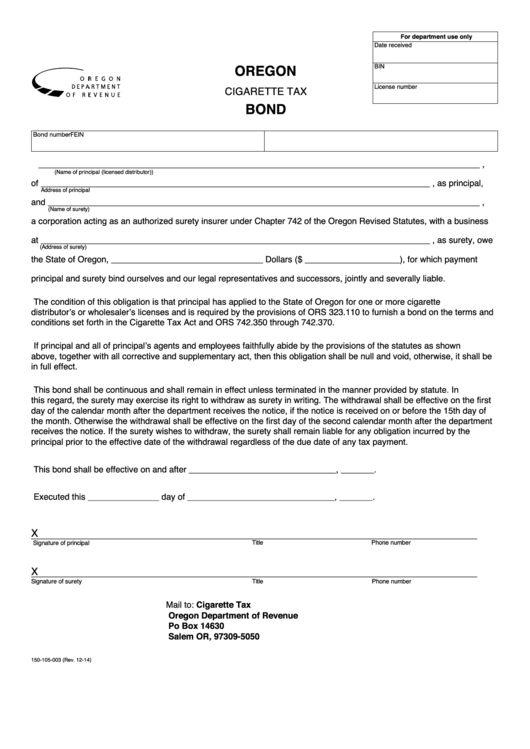

For department use only

Date received

OREGON

BIN

License number

CIGARETTE TAX

BOND

Bond number

FEIN

_____________________________________________________________________________________________ ,

(Name of principal (licensed distributor))

of __________________________________________________________________________________ , as principal,

Address of principal

and ___________________________________________________________________________________________ ,

(Name of surety)

a corporation acting as an authorized surety insurer under Chapter 742 of the Oregon Revised Statutes, with a business

at __________________________________________________________________________________ , as surety, owe

(Address of surety)

the State of Oregon, ________________________________ Dollars ($ ____________________), for which payment

principal and surety bind ourselves and our legal representatives and successors, jointly and severally liable.

The condition of this obligation is that principal has applied to the State of Oregon for one or more cigarette

distributor’s or wholesaler’s licenses and is required by the provisions of ORS 323.110 to furnish a bond on the terms and

conditions set forth in the Cigarette Tax Act and ORS 742.350 through 742.370.

If principal and all of principal’s agents and employees faithfully abide by the provisions of the statutes as shown

above, together with all corrective and supplementary act, then this obligation shall be null and void, otherwise, it shall be

in full effect.

This bond shall be continuous and shall remain in effect unless terminated in the manner provided by statute. In

this regard, the surety may exercise its right to withdraw as surety in writing. The withdrawal shall be effective on the first

day of the calendar month after the department receives the notice, if the notice is received on or before the 15th day of

the month. Otherwise the withdrawal shall be effective on the first day of the second calendar month after the department

receives the notice. If the surety wishes to withdraw, the surety shall remain liable for any obligation incurred by the

principal prior to the effective date of the withdrawal regardless of the due date of any tax payment.

This bond shall be effective on and after _______________________________, _______.

Executed this _______________ day of _______________________________, _______.

X

______________________________________________________________________________________________

Signature of principal

Title

Phone number

X

______________________________________________________________________________________________

Signature of surety

Title

Phone number

Mail to:

Cigarette Tax

Oregon Department of Revenue

Po Box 14630

Salem OR, 97309-5050

150-105-003 (Rev. 12-14)

1

1