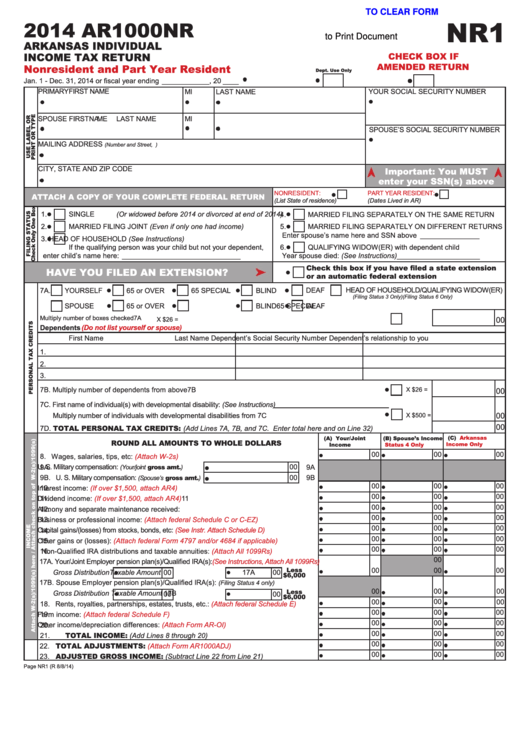

CLICK HERE TO CLEAR FORM

NR1

2014 AR1000NR

Click Here to Print Document

ARKANSAS INDIVIDUAL

INCOME TAX RETURN

CHECK BOX IF

AMENDED RETURN

Nonresident and Part Year Resident

Dept. Use Only

Jan. 1 - Dec. 31, 2014 or fiscal year ending ____________ , 20 ____

PRIMARY FIRST NAME

MI

LAST NAME

YOUR SOCIAL SECURITY NUMBER

SPOUSE FIRST NAME

MI

LAST NAME

Important

SPOUSE’S SOCIAL SECURITY NUMBER

MAILING ADDRESS

(Number and Street, P.O. Box or Rural Route)

CITY, STATE AND ZIP CODE

Important: You MUST

enter your SSN(s) above

NONRESIDENT:

PART YEAR RESIDENT:

ATTACH A COPY OF YOUR COMPLETE FEDERAL RETURN

(List State of residence)

(Dates Lived in AR)

1.

SINGLE (Or widowed before 2014 or divorced at end of 2014)

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN

2.

MARRIED FILING JOINT (Even if only one had income)

5.

MARRIED FILING SEPARATELY ON DIFFERENT RETURNS

Enter spouse’s name here and SSN above _______________

3.

HEAD OF HOUSEHOLD (See Instructions)

If the qualifying person was your child but not your dependent,

6.

QUALIFYING WIDOW(ER) with dependent child

enter child’s name here: ______________________________

Year spouse died: (See Instructions)_____________________

Check this box if you have filed a state extension

HAVE YOU FILED AN EXTENSION?

or an automatic federal extension

HEAD OF HOUSEHOLD/QUALIFYING WIDOW(ER)

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

(Filing Status 3 Only)

(Filing Status 6 Only)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

Multiply number of boxes checked .................................................................................................................................................7A

00

X $26 =

Dependents

(Do not list yourself or spouse)

First Name

Last Name

Dependent’s Social Security Number

Dependent’s relationship to you

1.

2.

3.

7B. Multiply number of dependents from above ...............................................................................................7B

X $26 =

00

7C. First name of individual(s) with developmental disability: (See Instructions)

00

Multiply number of individuals with developmental disabilities from 7C ........................................................ 7C

X $500 =

00

7D. TOTAL PERSONAL TAX CREDITS: (Add Lines 7A, 7B, and 7C. Enter total here and on Line 32).........................7D

(C)

Arkansas

(A)

Your/Joint

(B) Spouse’s Income

ROUND ALL AMOUNTS TO WHOLE DOLLARS

Income Only

Income

Status 4 Only

00

00

00

8.

Wages, salaries, tips, etc:

(Attach W-2s)

..................................................................8

9A.

U. S. Military compensation:

00

9A

(Your/joint gross amt.)

9B.

U. S. Military compensation:

00

9B

(Spouse’s gross amt.)

00

00

00

10.

Interest income:

(If over $1,500, attach AR4)

.........................................................10

00

00

00

11.

Dividend income:

(If over $1,500, attach AR4)

.......................................................11

00

00

00

12.

Alimony and separate maintenance received: .......................................................12

00

00

00

13.

Business or professional income:

................13

(Attach federal Schedule C or C-EZ)

00

00

00

14.

Capital gains/(losses) from stocks, bonds, etc:

(See Instr. Attach Schedule D)

.............14

00

00

00

15.

Other gains or (losses):

(Attach federal Form 4797 and/or 4684 if applicable)

......15

00

00

00

16.

Non-Qualified IRA distributions and taxable annuities: (Attach All

1099Rs)...........16

00

17A. Your/Joint Employer pension plan(s)/Qualified IRA(s):(See Instructions, Attach All 1099Rs)

Less

00

00

00

Gross Distribution

00

Taxable Amount

00

17A

$6,000

17B. Spouse Employer pension plan(s)/Qualified IRA(s):

(Filing Status 4 only)

00

00

00

Less

Gross Distribution

Taxable Amount

17B

00

00

$6,000

00

00

00

18.

Rents, royalties, partnerships, estates, trusts, etc.: (Attach federal Schedule

E)...... 18

00

00

00

19.

Farm income:

(Attach federal Schedule F)

............................................................. 19

00

00

00

Other income/depreciation differences:

................................ 20

20.

(Attach Form AR-OI)

00

00

00

TOTAL INCOME: (Add Lines 8 through 20) ....................................................... 21

21.

00

00

00

22. TOTAL ADJUSTMENTS:

(Attach Form AR1000ADJ)

...................................... 22

00

00

00

23. ADJUSTED GROSS INCOME: (Subtract Line 22 from Line 21) ..................... 23

Page NR1 (R 8/8/14)

1

1 2

2