Form 1040-Me - Maine Individual Income Tax Return Form

ADVERTISEMENT

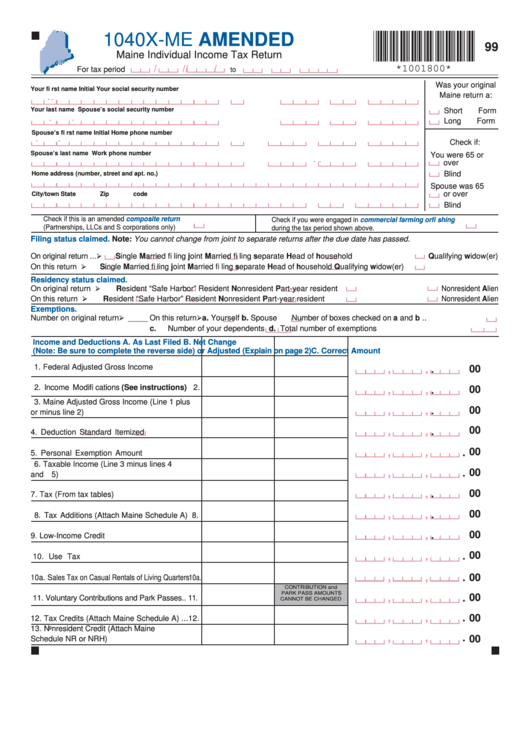

1040X-ME AMENDED

99

Maine Individual Income Tax Return

/

/

/

/

*1001800*

For tax period

to

Was your original

Your fi rst name

Initial

Your social security number

Maine return a:

-

-

Your last name

Spouse’s social security number

Short Form

-

-

Long Form

Spouse’s fi rst name

Initial

Home phone number

-

-

Check if:

Spouse’s last name

Work phone number

You were 65 or

-

-

over

Blind

Home address (number, street and apt. no.)

Spouse was 65

or over

City/town

State

Zip code

Blind

Check if this is an amended

composite return

Check if you were engaged in

commercial farming or fi shing

(Partnerships, LLCs and S corporations only)

during the tax period shown above.

Filing status claimed.

Note: You cannot change from joint to separate returns after the due date has passed.

On original return ...

Single

Married fi ling joint

Married fi ling separate

Head of household

Qualifying widow(er)

On this return .........

Single

Married fi ling joint

Married fi ling separate

Head of household

Qualifying widow(er)

Residency status

claimed.

On original return ................

Resident

“Safe Harbor” Resident

Nonresident

Part-year resident

Nonresident Alien

On this return ......................

Resident

“Safe Harbor” Resident

Nonresident

Part-year resident

Nonresident Alien

Exemptions.

Number on original return

On this return

a.

Yourself

b.

Spouse

Number of boxes checked on a and b ..

_____

c. Number of your dependents

d. Total number of exemptions

.......................

Income and Deductions

A. As Last Filed

B. Net Change

(Note: Be sure to complete the reverse side)

or Adjusted

(Explain on page 2)

C. Correct Amount

1. Federal Adjusted Gross Income .............. 1.

00

,

,

.

2. Income Modifi cations (See instructions) 2.

00

,

,

.

3. Maine Adjusted Gross Income (Line 1 plus

00

,

,

.

or minus line 2) ........................................ 3.

00

,

,

.

4. Deduction

Standard

Itemized .... 4.

00

,

,

.

5. Personal Exemption Amount ................... 5.

6. Taxable Income (Line 3 minus lines 4

00

,

,

.

and 5) ...................................................... 6.

00

,

,

.

7. Tax (From tax tables)............................... 7.

00

,

,

.

8. Tax Additions (Attach Maine Schedule A) 8.

00

,

,

.

9. Low-Income Credit ................................. 9.

00

,

,

.

10. Use Tax ................................................. 10.

,

,

.

00

10a. Sales Tax on Casual Rentals of Living Quarters 10a.

CONTRIBUTION and

PARK PASS AMOUNTS

00

,

,

.

11. Voluntary Contributions and Park Passes.. 11.

CANNOT BE CHANGED

,

,

.

00

12. Tax Credits (Attach Maine Schedule A) ... 12.

13. Nonresident Credit (Attach Maine

,

,

.

00

Schedule NR or NRH) ............................. 13.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2