Tc-65 Schedule A - Utah Income For Nonresident Partners Form

ADVERTISEMENT

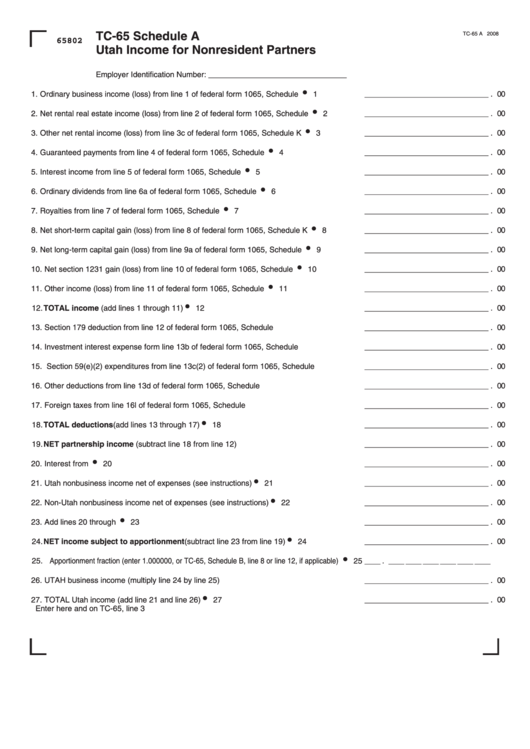

TC-65 Schedule A

TC-65 A 2008

65802

Utah Income for Nonresident Partners

Employer Identification Number: ________ ___ ___ ___ __

1. Ordinary business income (loss) from line 1 of federal form 1065, Schedule K .........

1 _ ___ ___ ___ ___ _ _ _ _ . 00

2. Net rental real estate income (loss) from line 2 of federal form 1065, Schedule K .....

2 _ ___ ___ ___ ___ _ _ _ _ . 00

3. Other net rental income (loss) from line 3c of federal form 1065, Schedule K ...........

3 _ __ ___ ___ ___ _ _ _ _ _ . 00

4. Guaranteed payments from line 4 of federal form 1065, Schedule K .........................

4 _ __ ___ ___ ___ _ _ _ _ _ . 00

5. Interest income from line 5 of federal form 1065, Schedule K ....................................

5 _ __ ___ ___ ___ _ _ _ _ _ . 00

6. Ordinary dividends from line 6a of federal form 1065, Schedule K.............................

6 _ __ ___ ___ ___ _ _ _ _ _ . 00

7. Royalties from line 7 of federal form 1065, Schedule K ..............................................

7 _ __ ___ ___ ___ _ _ _ _ _ . 00

8. Net short-term capital gain (loss) from line 8 of federal form 1065, Schedule K ........

8 _ ___ ___ ___ ___ _ _ _ _ . 00

9. Net long-term capital gain (loss) from line 9a of federal form 1065, Schedule K........

9 _ ___ ___ ___ ___ _ _ _ _ . 00

10. Net section 1231 gain (loss) from line 10 of federal form 1065, Schedule K ..............

10 _ __ ___ ___ ___ _ _ _ _ _ . 00

11. Other income (loss) from line 11 of federal form 1065, Schedule K ...........................

11 _ __ ___ ___ ___ _ _ _ _ _ . 00

12. TOTAL income (add lines 1 through 11) ....................................................................

12 ___ ___ ___ ___ _ _ _ _ _ . 00

13. Section 179 deduction from line 12 of federal form 1065, Schedule K .......................

13 ___ ___ ___ ___ _ _ _ _ _ . 00

14. Investment interest expense form line 13b of federal form 1065, Schedule K ............

14 _ __ ___ ___ ___ _ _ _ _ _ . 00

15. Section 59(e)(2) expenditures from line 13c(2) of federal form 1065, Schedule K .....

15 _ __ ___ ___ ___ _ _ _ _ _ . 00

16. Other deductions from line 13d of federal form 1065, Schedule K .............................

16 ___ ___ ___ ___ _ _ _ _ _ . 00

17. Foreign taxes from line 16l of federal form 1065, Schedule K ....................................

17 _ __ ___ ___ ___ _ _ _ _ _ . 00

18. TOTAL deductions (add lines 13 through 17) ...........................................................

18 _ __ ___ ___ ___ _ _ _ _ _ . 00

19. NET partnership income (subtract line 18 from line 12)...........................................

19 _ __ ___ ___ ___ _ _ _ _ _ . 00

20. Interest from U.S. Government obligations included in line 5 above...........................

20 _ ___ ___ ___ ___ _ _ _ _ . 00

21. Utah nonbusiness income net of expenses (see instructions)....................................

21 ___ ___ ___ ___ _ _ _ _ _ . 00

22. Non-Utah nonbusiness income net of expenses (see instructions) ............................

22 _ __ ___ ___ ___ _ _ _ _ _ . 00

23. Add lines 20 through 22 ..............................................................................................

23 ___ ___ ___ __ __ _ _ _ _ . 00

24. NET income subject to apportionment (subtract line 23 from line 19) ...................

24 _ ___ ___ ___ ___ _ _ _ _ . 00

25. Apportionment fraction (enter 1.000000, or TC-65, Schedule B, line 8 or line 12, if applicable)

25 __ . _ _ __ __ _ _ _ _ _ _

26. UTAH business income (multiply line 24 by line 25) ...................................................

26 _ __ ___ ___ ___ _ _ _ _ _ . 00

27. TOTAL Utah income (add line 21 and line 26) ............................................................

27 ___ ___ ___ ___ _ _ _ _ _ . 00

Enter here and on TC-65, line 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1