Form Uct-6 - Employer'S Quarterly Report - 2008

ADVERTISEMENT

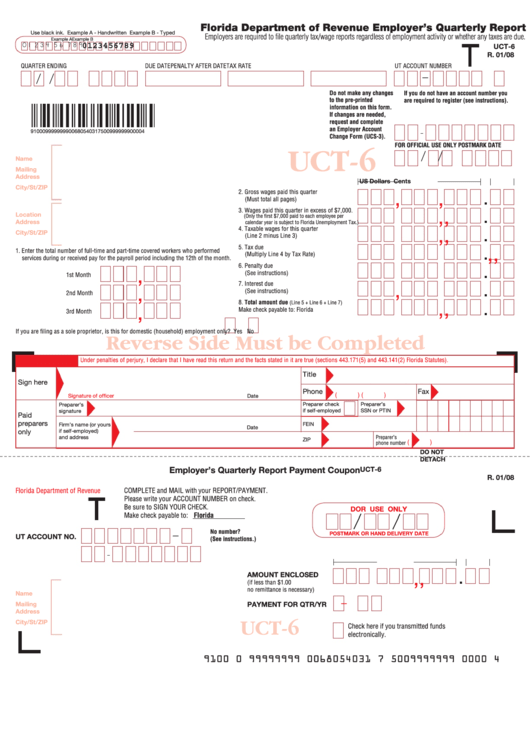

Florida Department of Revenue Employer’s Quarterly Report

Use black ink. Example A - Handwritten Example B - Typed

Employers are required to file quarterly tax/wage reports regardless of employment activity or whether any taxes are due.

Example A

Example B

0 1 2 3 4 5 6 7 8 9

0123456789

UCT-6

R. 01/08

QUARTER ENDING

DUE DATE

PENALTY AFTER DATE

TAx RATE

UT ACCOUNT NUMBER

-

/

/

do not make any changes

If you do not have an account number you

to the pre-printed

are required to register (see instructions).

information on this form.

if changes are needed,

F.E.I. NUMBER

request and complete

an Employer Account

910009999999900680540317500999999900004

Change Form (UCs-3).

For oFFiCial Use only PosTmark daTe

UCT-6

/

/

Name

Mailing

Address

US Dollars

Cents

City/St/ZiP

,

,

2. Gross wages paid this quarter

(Must total all pages)

,

,

3. Wages paid this quarter in excess of $7,000.

Location

(Only the first $7,000 paid to each employee per

Address

calendar year is subject to Florida Unemployment Tax.)

,

,

4. Taxable wages for this quarter

City/St/ZiP

(Line 2 minus Line 3)

,

,

5. Tax due

1. Enter the total number of full-time and part-time covered workers who performed

(Multiply Line 4 by Tax Rate)

services during or received pay for the payroll period including the 12th of the month.

,

,

6. Penalty due

,

(See instructions)

1st Month

,

,

7. Interest due

,

(See instructions)

2nd Month

,

,

8. Total amount due

(Line 5 + Line 6 + Line 7)

,

Make check payable to: Florida U.C. Fund

3rd Month

If you are filing as a sole proprietor, is this for domestic (household) employment only?

Yes

No

Reverse Side Must be Completed

Under penalties of perjury, I declare that I have read this return and the facts stated in it are true (sections 443.171(5) and 443.141(2) Florida Statutes).

Title

Sign here

Phone

Fax

(

)

(

)

Signature of officer

Date

Preparer check

Preparer’s

Preparer’s

if self-employed

SSN or PTIN

signature

Paid

preparers

FEIN

Firm’s name (or yours

Date

only

if self-employed)

Preparer’s

and address

ZIP

(

)

phone number

DO NOT

DETACH

Employer’s Quarterly Report Payment Coupon

UCT-6

R. 01/08

COMPLETE and MAIL with your REPORT/PAYMENT.

Florida Department of Revenue

Please write your ACCOUNT NUMBER on check.

Be sure to SIGN YOUR CHECK.

DOR USE ONLy

Make check payable to: Florida U.C. Fund

-

No number?

POSTMARk OR HAND DELivERy DATE

UT ACCOUNT NO.

(See instructions.)

F.E.i. NUMbER

U.S. Dollars

Cents

,

,

AMOUNT ENCLOSED

(if less than $1.00

no remittance is necessary)

Name

-

PAyMENT FOR QTR/yR

Mailing

Address

UCT-6

City/St/ZiP

Check here if you transmitted funds

electronically.

9100 0 99999999 0068054031 7 5009999999 0000 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3