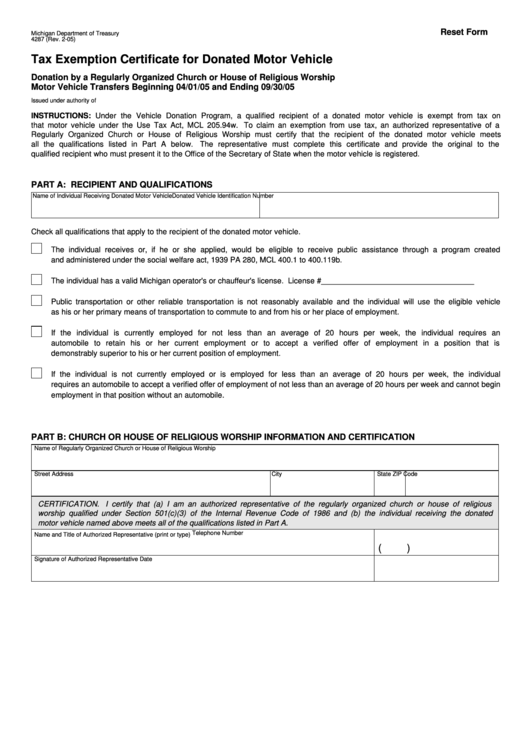

Reset Form

Michigan Department of Treasury

4287 (Rev. 2-05)

Tax Exemption Certificate for Donated Motor Vehicle

Donation by a Regularly Organized Church or House of Religious Worship

Motor Vehicle Transfers Beginning 04/01/05 and Ending 09/30/05

Issued under authority of P.A. 435 of 2004.

INSTRUCTIONS: Under the Vehicle Donation Program, a qualified recipient of a donated motor vehicle is exempt from tax on

that motor vehicle under the Use Tax Act, MCL 205.94w. To claim an exemption from use tax, an authorized representative of a

Regularly Organized Church or House of Religious Worship must certify that the recipient of the donated motor vehicle meets

all the qualifications listed in Part A below.

The representative must complete this certificate and provide the original to the

qualified recipient who must present it to the Office of the Secretary of State when the motor vehicle is registered.

PART A: RECIPIENT AND QUALIFICATIONS

Name of Individual Receiving Donated Motor Vehicle

Donated Vehicle Identification Number

Check all qualifications that apply to the recipient of the donated motor vehicle.

The individual receives or, if he or she applied, would be eligible to receive public assistance through a program created

and administered under the social welfare act, 1939 PA 280, MCL 400.1 to 400.119b.

The individual has a valid Michigan operator's or chauffeur's license. License #___________________________________

Public transportation or other reliable transportation is not reasonably available and the individual will use the eligible vehicle

as his or her primary means of transportation to commute to and from his or her place of employment.

If the individual is currently employed for not less than an average of 20 hours per week, the individual requires an

automobile to retain his or her current employment or to accept a verified offer of employment in a position that is

demonstrably superior to his or her current position of employment.

If the individual is not currently employed or is employed for less than an average of 20 hours per week, the individual

requires an automobile to accept a verified offer of employment of not less than an average of 20 hours per week and cannot begin

employment in that position without an automobile.

PART B: CHURCH OR HOUSE OF RELIGIOUS WORSHIP INFORMATION AND CERTIFICATION

Name of Regularly Organized Church or House of Religious Worship

Street Address

City

State

ZIP Code

CERTIFICATION. I certify that (a) I am an authorized representative of the regularly organized church or house of religious

worship qualified under Section 501(c)(3) of the Internal Revenue Code of 1986 and (b) the individual receiving the donated

motor vehicle named above meets all of the qualifications listed in Part A.

Telephone Number

Name and Title of Authorized Representative (print or type)

(

)

Signature of Authorized Representative

Date

1

1