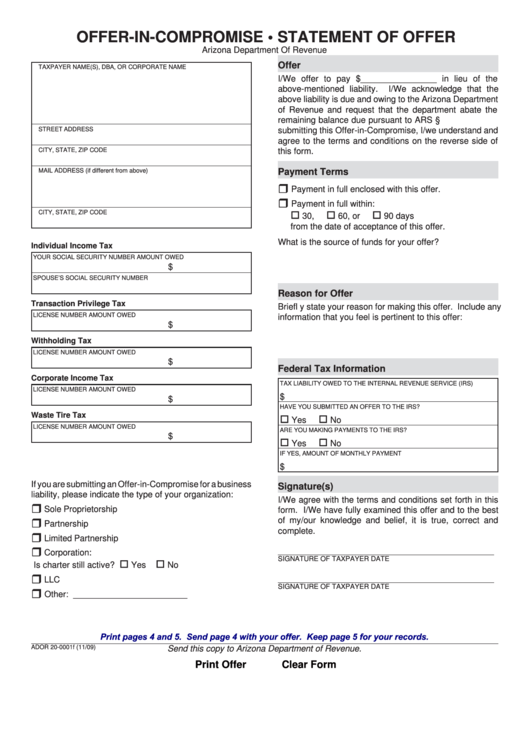

OFFER-IN-COMPROMISE • STATEMENT OF OFFER

Arizona Department Of Revenue

Offer

TAXPAYER NAME(S), DBA, OR CORPORATE NAME

I/We offer to pay $________________ in lieu of the

above-mentioned liability.

I/We acknowledge that the

above liability is due and owing to the Arizona Department

of Revenue and request that the department abate the

remaining balance due pursuant to ARS §42-1004.B. By

STREET ADDRESS

submitting this Offer-in-Compromise, I/we understand and

agree to the terms and conditions on the reverse side of

CITY, STATE, ZIP CODE

this form.

Payment Terms

MAIL ADDRESS (if different from above)

Payment in full enclosed with this offer.

Payment in full within:

CITY, STATE, ZIP CODE

30,

60, or

90 days

from the date of acceptance of this offer.

What is the source of funds for your offer?

Individual Income Tax

YOUR SOCIAL SECURITY NUMBER

AMOUNT OWED

$

SPOUSE’S SOCIAL SECURITY NUMBER

Reason for Offer

Transaction Privilege Tax

Briefl y state your reason for making this offer. Include any

LICENSE NUMBER

AMOUNT OWED

information that you feel is pertinent to this offer:

$

Withholding Tax

LICENSE NUMBER

AMOUNT OWED

$

Federal Tax Information

Corporate Income Tax

TAX LIABILITY OWED TO THE INTERNAL REVENUE SERVICE (IRS)

LICENSE NUMBER

AMOUNT OWED

$

$

HAVE YOU SUBMITTED AN OFFER TO THE IRS?

Waste Tire Tax

Yes

No

LICENSE NUMBER

AMOUNT OWED

ARE YOU MAKING PAYMENTS TO THE IRS?

$

Yes

No

IF YES, AMOUNT OF MONTHLY PAYMENT

$

If you are submitting an Offer-in-Compromise for a business

Signature(s)

liability, please indicate the type of your organization:

I/We agree with the terms and conditions set forth in this

Sole Proprietorship

form. I/We have fully examined this offer and to the best

of my/our knowledge and belief, it is true, correct and

Partnership

complete.

Limited Partnership

Corporation:

SIGNATURE OF TAXPAYER

DATE

Is charter still active?

Yes

No

LLC

SIGNATURE OF TAXPAYER

DATE

Other: ________________________

Print pages 4 and 5. Send page 4 with your offer. Keep page 5 for your records.

ADOR 20-0001f (11/09)

Send this copy to Arizona Department of Revenue.

Print Offer

Clear Form

1

1