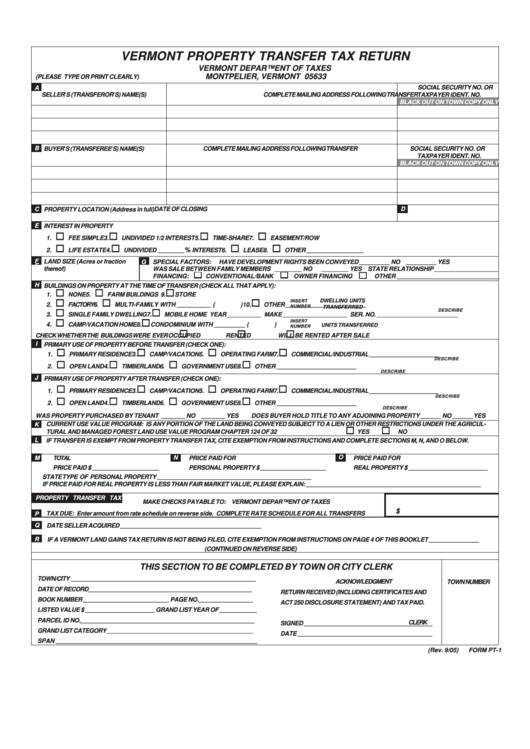

VERMONT PROPERTY TRANSFER TAX RETURN

VERMONT DEPARTMENT OF TAXES

MONTPELIER, VERMONT 05633

(PLEASE TYPE OR PRINT CLEARLY)

A

SOCIAL SECURITY NO. OR

SELLER'S (TRANSFEROR'S) NAME(S)

COMPLETE MAILING ADDRESS FOLLOWING TRANSFER

TAXPAYER IDENT. NO.

BLACK OUT ON TOWN COPY ONLY

B

COMPLETE MAILING ADDRESS FOLLOWING TRANSFER

SOCIAL SECURITY NO. OR

BUYER'S (TRANSFEREE'S) NAME(S)

TAXPAYER IDENT. NO.

BLACK OUT ON TOWN COPY ONLY

D

C

DATE OF CLOSING

PROPERTY LOCATION (Address in full)

E

INTEREST IN PROPERTY

1.

FEE SIMPLE

3.

UNDIVIDED 1/2 INTEREST

5.

TIME-SHARE

7.

EASEMENT/ROW

%

2.

LIFE ESTATE

4.

UNDIVIDED ________

INTEREST

6.

LEASE

8.

OTHER _________________

F

LAND SIZE (Acres or fraction

G

SPECIAL FACTORS: HAVE DEVELOPMENT RIGHTS BEEN CONVEYED _________ NO _________ YES

F

thereof)

WAS SALE BETWEEN FAMILY MEMBERS ________ NO

________ YES STATE RELATIONSHIP ___________________

FINANCING:

CONVENTIONAL/BANK

OWNER FINANCING

OTHER ______________________________

H

BUILDINGS ON PROPERTY AT THE TIME OF TRANSFER (CHECK ALL THAT APPLY):

1.

NONE

5.

FARM BUILDINGS

9.

STORE

DWELLING UNITS

INSERT

2.

FACTORY

6.

MULTI-FAMILY WITH __________ (

)

10.

OTHER ________________________

NUMBER

TRANSFERRED

DESCRIBE

3.

SINGLE FAMILY DWELLING

7.

MOBILE HOME YEAR __________ MAKE ___________________ SER. NO. ________________________

INSERT

4.

CAMP/VACATION HOME

8.

CONDOMINIUM WITH _________ (

)

UNITS TRANSFERRED

NUMBER

CHECK WHETHER THE BUILDINGS WERE EVER

OCCUPIED

RENTED

WILL BE RENTED AFTER SALE

I

PRIMARY USE OF PROPERTY BEFORE TRANSFER (CHECK ONE):

1.

PRIMARY RESIDENCE

3.

CAMP/VACATION 5.

OPERATING FARM

7.

COMMERCIAL/INDUSTRIAL _____________________

DESCRIBE

2.

OPEN LAND

4.

TIMBERLAND

6.

GOVERNMENT USE

8.

OTHER ________________________

DESCRIBE

J

PRIMARY USE OF PROPERTY AFTER TRANSFER (CHECK ONE):

1.

PRIMARY RESIDENCE

3.

CAMP/VACATION

5.

OPERATING FARM

7.

COMMERCIAL/INDUSTRIAL _____________________

DESCRIBE

2.

OPEN LAND

4.

TIMBERLAND

6.

GOVERNMENT USE

8.

OTHER ________________________

DESCRIBE

WAS PROPERTY PURCHASED BY TENANT _______ NO _______ YES

DOES BUYER HOLD TITLE TO ANY ADJOINING PROPERTY ______ NO ______ YES

CURRENT USE VALUE PROGRAM: IS ANY PORTION OF THE LAND BEING CONVEYED SUBJECT TO A LIEN OR OTHER RESTRICTIONS UNDER THE AGRICUL-

K

TURAL AND MANAGED FOREST LAND USE VALUE PROGRAM CHAPTER 124 OF 32 V.S.A.

YES

NO

L

IF TRANSFER IS EXEMPT FROM PROPERTY TRANSFER TAX, CITE EXEMPTION FROM INSTRUCTIONS AND COMPLETE SECTIONS M, N, AND O BELOW.

O

M

N

TOTAL

PRICE PAID FOR

PRICE PAID FOR

PRICE PAID $ ____________________

PERSONAL PROPERTY $ ____________________

REAL PROPERTY $ ________________________

STATE TYPE OF PERSONAL PROPERTY _______________________________________________

IF PRICE PAID FOR REAL PROPERTY IS LESS THAN FAIR MARKET VALUE, PLEASE EXPLAIN: _____________________________________________________

PROPERTY TRANSFER TAX

MAKE CHECKS PAYABLE TO: VERMONT DEPARTMENT OF TAXES

$

TAX DUE: Enter amount from rate schedule on reverse side. COMPLETE RATE SCHEDULE FOR ALL TRANSFERS

P

Q

DATE SELLER ACQUIRED ___________________________________________

R

IF A VERMONT LAND GAINS TAX RETURN IS NOT BEING FILED, CITE EXEMPTION FROM INSTRUCTIONS ON PAGE 4 OF THIS BOOKLET _______________

(CONTINUED ON REVERSE SIDE)

THIS SECTION TO BE COMPLETED BY TOWN OR CITY CLERK

TOWN/CITY ______________________________________________________

ACKNOWLEDGMENT

TOWN NUMBER

DATE OF RECORD ________________________________________________

RETURN RECEIVED (INCLUDING CERTIFICATES AND

BOOK NUMBER __________________________ PAGE NO. ________________

ACT 250 DISCLOSURE STATEMENT) AND TAX PAID.

LISTED VALUE $ _____________________ GRAND LIST YEAR OF ___________

PARCEL ID NO. ___________________________________________________

CLERK

SIGNED _______________________________________

GRAND LIST CATEGORY ___________________________________________

DATE _________________________________________

SPAN ___________________________________________________________

(Rev. 9/05)

FORM PT-1

1

1 2

2