Wv/bot-300e 1/07 - Business & Occupation Tax Estimate Form - West Virginia

ADVERTISEMENT

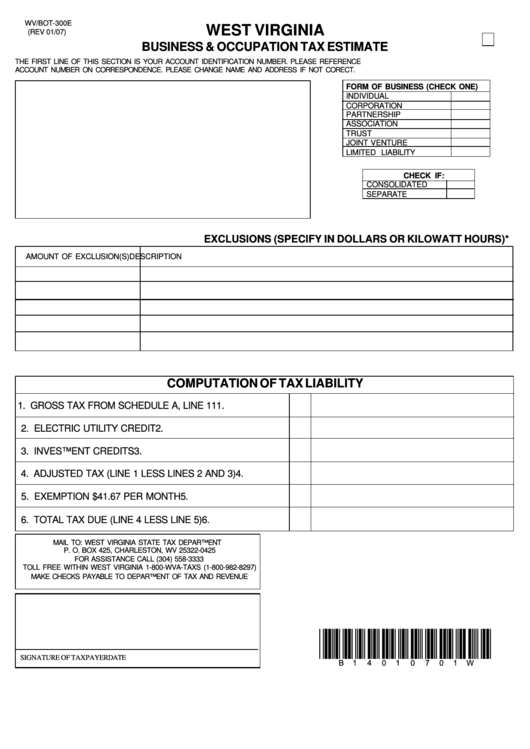

WV/BOT-300E

WEST VIRGINIA

(REV 01/07)

BUSINESS & OCCUPATION TAX ESTIMATE

THE FIRST LINE OF THIS SECTION IS YOUR ACCOUNT IDENTIFICATION NUMBER. PLEASE REFERENCE

ACCOUNT NUMBER ON CORRESPONDENCE. PLEASE CHANGE NAME AND ADDRESS IF NOT CORECT.

FORM OF BUSINESS (CHECK ONE)

INDIVIDUAL

CORPORATION

PARTNERSHIP

ASSOCIATION

TRUST

JOINT VENTURE

LIMITED LIABILITY

CHECK IF:

CONSOLIDATED

SEPARATE

EXCLUSIONS (SPECIFY IN DOLLARS OR KILOWATT HOURS)*

AMOUNT OF EXCLUSION(S)

DESCRIPTION

COMPUTATION OF TAX LIABILITY

1. GROSS TAX FROM SCHEDULE A, LINE 11

1.

2. ELECTRIC UTILITY CREDIT

2.

3. INVESTMENT CREDITS

3.

4. ADJUSTED TAX (LINE 1 LESS LINES 2 AND 3)

4.

5. EXEMPTION $41.67 PER MONTH

5.

6. TOTAL TAX DUE (LINE 4 LESS LINE 5)

6.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

P. O. BOX 425, CHARLESTON, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333

TOLL FREE WITHIN WEST VIRGINIA 1-800-WVA-TAXS (1-800-982-8297)

MAKE CHECKS PAYABLE TO DEPARTMENT OF TAX AND REVENUE

*B14010701W*

SIGNATURE OF TAXPAYER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2